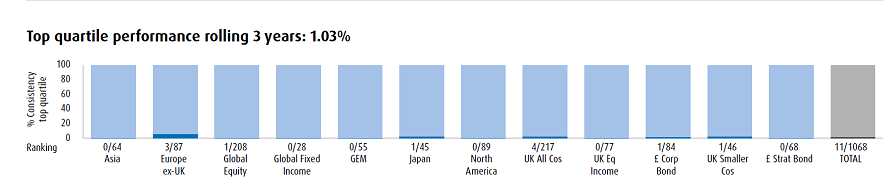

Just 11 of the 1,068 funds in the 12 main Investment Association sectors have delivered consistent top-quartile returns in each of the past three one-year periods – equivalent to just 1% – according to the latest BMO Multi-Manager FundWatch survey.

This represented a decline on the previous quarter, which saw 20 funds (1.9%) make the grade, and is considerably lower than the historic range of between 2 and 4%.

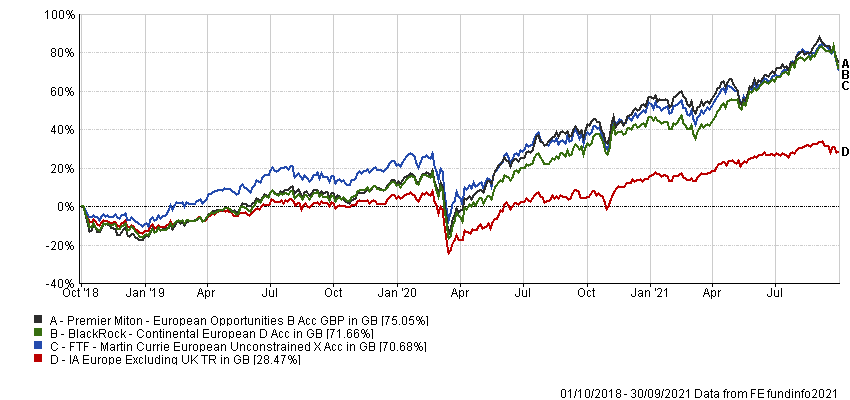

Of the 12 main sectors, IA Europe ex UK had the highest proportion of funds with top-quartile returns in each of the three one-year periods, with three – or 3.5% of the total – achieving this feat: Martin Currie European Unconstrained, Premier Miton European Opportunities and BlackRock Continental European.

Performance of funds vs sector over 3yrs

Source: FE Analytics

This was followed by IA Japan and IA UK Smaller Companies, where 2.2% of funds in each sector made the grade. In reality, however, this equated to just one fund in both cases: FSSA Japan Focus and Liontrust UK Micro Cap.

In half of the 12 sectors, there wasn’t a single fund that managed to deliver top-quartile performance over all the three years in question: IA Global Mixed Bond, IA Asia ex Japan, IA Emerging Markets, IA North American, IA UK Equity Income and IA Sterling Strategic Bond.

Source: BMO

“It has been 18 months since the start of the Covid pandemic, marking half of the three-year period analysed in our FundWatch survey,” said Kelly Prior, investment manager in BMO’s multi-manager team.

“This period of volatility has had a negative impact on the consistent delivery of top-quartile fund performance across the IA universe.

“Certainly, 2020 could be characterised as a year in which growth investing dominated, but 2021 has brought a greater focus on the price you are paying. Few managers will flip their portfolios to succeed in such different market conditions, so when you look for consistency relative to the peer group over shorter time frames, you are likely to continue to be left wanting.”

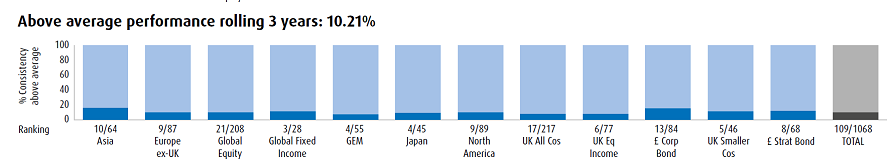

Even lowering the hurdle rate down to ‘above median’ in each of the last three 12-month periods saw just 109 of the 1,068 funds make the grade, equivalent to 10.2%. This was down from 12.5% when the study was last conducted, in Q2.

However, all 12 main IA sectors contained funds that beat this less demanding hurdle. The most consistent sector on this measure was IA Asia ex Japan, with 15.6% of funds delivering above-median performance for three consecutive years.

The IA Sterling Corporate Bond and IA Sterling Strategic Bond sectors were the next best, with 15.5% and 11.8% achieving the target respectively. IA Emerging Markets was the least consistent, with just 7.3% of funds beating the hurdle.

Source: BMO

“Since the global financial crisis, active fund management has faced an uphill struggle as macro factors, mainly influenced by exceptionally low interest rates, have meant a lack of creative destruction,” Prior added.

“This is not ideal for those that get paid to sort the corporate wheat from the chaff. The result has been a boom in passive/non-fundamental investing.

“With the well-telegraphed reversal of these policies, we are seeing a jostling for position going on within different areas of investment. It’s going to be an interesting few quarters from here.”

Another way BMO attempted to establish consistency of performance was to look for funds that managed to deliver what it called the ‘Holy Grail’ of top-of-the-sector returns with bottom-of-the-sector volatility. For these purposes, it used a longer time period, looking back over the full three years rather than three one-year periods.

No fund beat this lofty hurdle – Royal London Sustainable Leaders Trust came closest, achieving 99th-percentile risk, but ‘only’ sixth-percentile returns.

“A simplistic observation could be that you have been able to make good returns in these years, but you may have had to weather more volatile performance to achieve it,” said Prior.

“The middle ground is becoming a crowded place – to achieve long-term excellence, patience is a necessity.”

What was more positive for investors was the lack of funds that lost money over the three-year period. Of 4,757 funds in all 52 sectors, 4,694 made a positive return – or 98.7%.