Bonds have been a poor place to park your cash over the past few years with the majority of fixed income fund sectors failing to make a positive return, FE fundinfo data shows.

Indeed, of the 22 Investment Association sectors to invest in fixed income, just eight have made a positive return over three years, while over the past 12 months this number drops to three – all of which are dollar-denominated bond funds.

However, some analysts are convinced that now is the time to be buying into the asset class, which could benefit from higher yields, which should protect better against inflation.

Earlier this week Myles Bradshaw, head of global aggregate fixed income strategies at JP Morgan, said now is the perfect time to buy bonds if you haven’t already.

Meanwhile, Quilter Investors portfolio manager Stuart Clark decided to reduce exposure to equities and cash in favour of traditional credit across his WealthSelect model portfolios, citing the potential for returns on equities to be “disappointing” from here.

As such, Trustnet extended its series looking at the funds that have made above-average dividend payments over five years.

Previously, we have looked at the IA UK Equity Income, IA Global Equity Income, IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors.

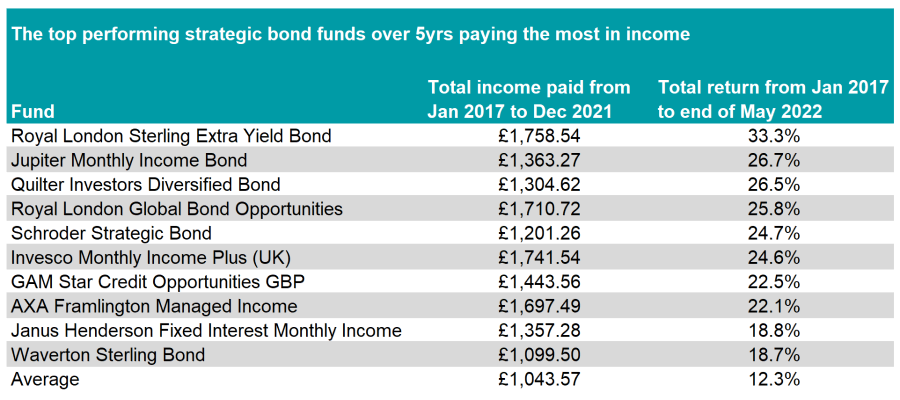

To do this we calculated the total amount paid on an initial £10,000 investment made at the start of 2017, to the end of 2021.

We then looked at the total returns of these funds from January 2017 until the end of May 2022 to show those that have managed to make money from capital returns as well.

Source: FE Analytics

Over five years the average fund in the sector has made a 12.3% total return while paying out £1,043.57 on an initial £10,000 investment.

However, the top-performing Royal London Sterling Extra Yield Bond fund has almost tripled this, making 33.3% while paying out £1,758.54 over this time – the highest among qualifying funds.

The fund also came out on top as the most consistent strategic bond fund over the past decade in Trustnet’s study earlier in the year, beating the sector average in eight of the past 10 calendar years and making a positive return in every one.

Managers Eric Holt and Rachid Semaoune aim to provide investors with a high yield without taking the degree of risk normally associated with high-yield funds.

The fund is highly diverse, with more than 200 holdings and typically has around 30% of the portfolio allocated to unrated bonds.

Second on the list was the Jupiter Monthly Income Bond, which paid out £1,363.27 over five years while making 26.7% in total returns.

Managed by Adam Darling, Harry Richards and Hilary Blandy since July 2020, is predominantly invested in corporate high yield bonds, with more than half (56.6%) of the portfolio in the asset class.

It focuses on the range between investment grade and high yield, with three-quarters of the fund invested in bonds ranging from BBB to B and has a relatively short duration of 3.3 years.

The Invesco Monthly Income Plus (UK) fund is another of note. The portfolio has paid out £1,741.54 over the past five years while making 24.6% in total returns.

Rhys Davies, co-manager of the fund, said that recent price moves have created several opportunities for the portfolio, which can invest across both corporate and government bonds.

“Following years of low interest rates and falling bond yields we are now seeing higher yields and more volatility in markets. This has provided the opportunity to deliver attractive levels of income for investors as well as the potential for capital growth,” he said.

“All of our recent purchases were made at far more attractive yields than were on offer just six months ago. Adaptability will be key to navigating this investment backdrop and as we are not constrained by credit, sector or geographical limitations, we can go further in the search for yield and are excited about the opportunities that lie ahead.”