Emerging markets are characterised by rapid GDP growth and industrialisation, which can lead to some very high returns – albeit with quite a lot of volatility – and create a broad range of opportunities for investors.

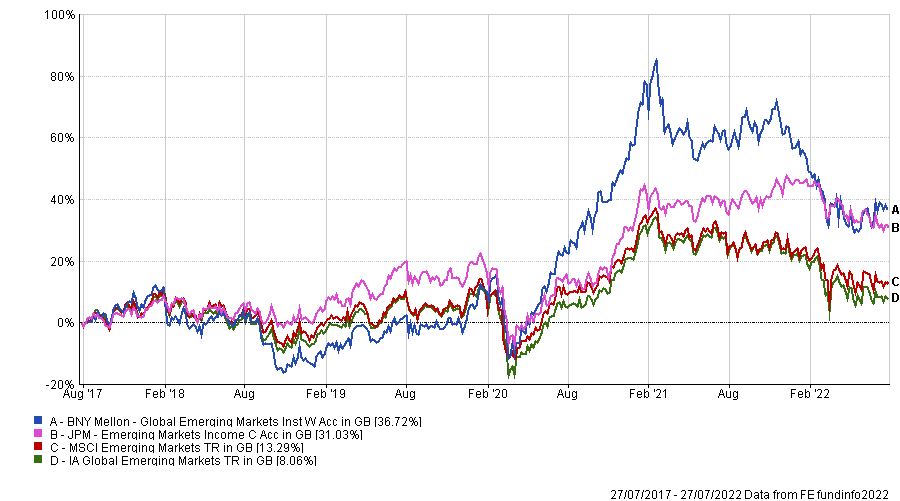

As part of our ongoing series, Trustnet has found the IA Global Emerging Markets and IA Latin America funds that were within the top 10% of their peers for alpha, information ratio and total return over the past five years.

Not only did the funds outperform on the above criteria, but they also did so at a below average cost. Investors can therefore access top alpha, a measurement used to calculate a fund’s returns above its benchmark, without it costing a fortune

Some of the emerging markets’ largest economies, China and India, were analysed in Trustnet’s previous study of Asian funds.

We’ve also looked at the cheapest funds offering top alpha, information ratios and total returns in the IA North America, IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors.

IA Global Emerging Markets

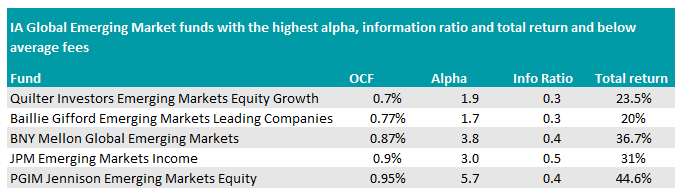

The cheapest IA Global Emerging Markets member to tick all the boxes was the Quilter Investors Emerging Markets Equity Growth fund, which charged investors a fee of 0.7%.

It holds most of its assets across China and India, with the two countries accounting for 51.6% of the fund’s geographical exposure.

Over the past five years, the fund jumped 15.5 percentage points ahead of its peer group, delivering a total return of 23.5%.

Total return of fund vs index and sector over 5yrs

Source: FE Analytics

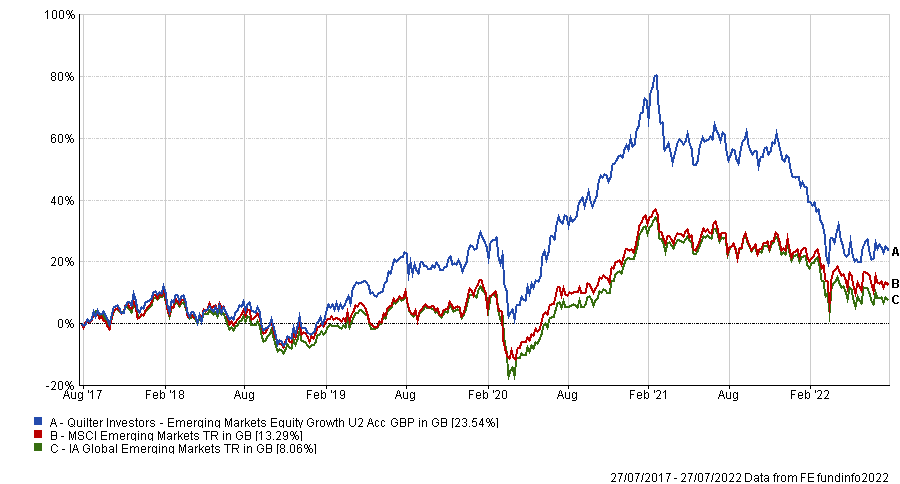

However, for a slightly higher fee (that’s still below the sector average), the PGIM Jennison Emerging Markets Equity made a higher return over the period.

It was the best performer in the sector over the past five years, with returns reaching 44.6%, although it came with the highest price tag on the list of 0.95%. The 5.7 alpha rating also made it was the highest in terms of alpha too.

Again, its two largest regional allocations are to China and India (65.5%), while its two largest overweight positions are in the consumer staples and industrials sectors.

Total return of fund vs index and sector over 5yrs

Source: FE Analytics

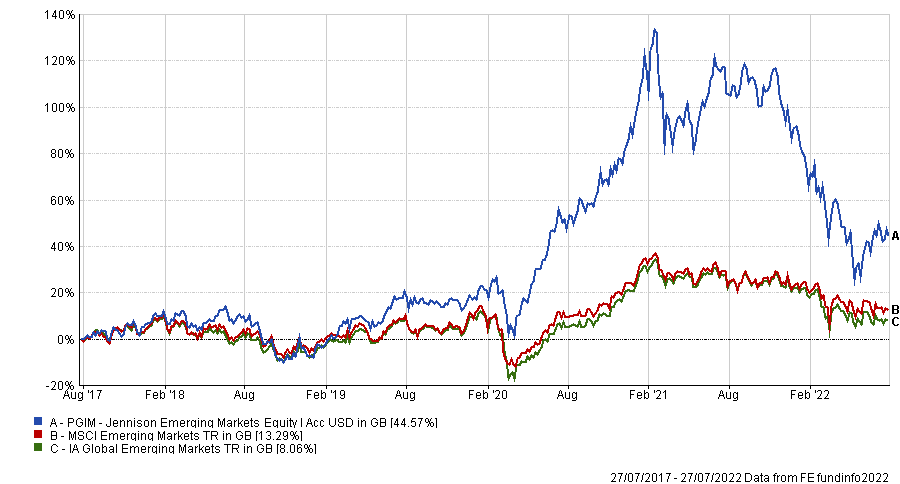

Alternatively, the JPM Emerging Markets Income fund has the highest information ratio at 0.5.

It was up 31% over the past five years, billing investor an ongoing charge figure (OCF) of 0.9%.

Unlike the previous two portfolios, India was not of the top regional allocations. In fact, its exposure to the market was 6 percentage points lower than the benchmark’s.

For a slightly lower fee of 0.87%, however, the BNY Mellon Global Emerging Markets fund delivered a better return over the period, climbing 36.7%.

Total return of funds vs index and sector over the past five years

Source: FE Analytics

Baillie Gifford’s Emerging Markets Leading Companies fund was the largest on the list, with assets under management (AUM) of almost £900m, but had the lowest total return.

The portfolio, managed by FE fundinfo Alpha Managers Will Sutcliffe and Roderick Snell, was up 20% over the past five years, placing it within the top 10% of the sector but bottom of those listed here.

That being said, its 0.77% charge makes it the second cheapest.

IA Latin America

IA Latin America provided a much smaller pool of funds, within only 10 portfolios within the sector, but given its strong performance over 2022 so far, we thought it was worth looking at.

Of all of them, the HSBC MSCI EM Latin America UCITS ETF fund had the lowest OCF of 0.6%.

The tracker fund is down 6.6% over the past five years but still had a 4.3 percentage point lead on its peer group, which declined 10.9%.

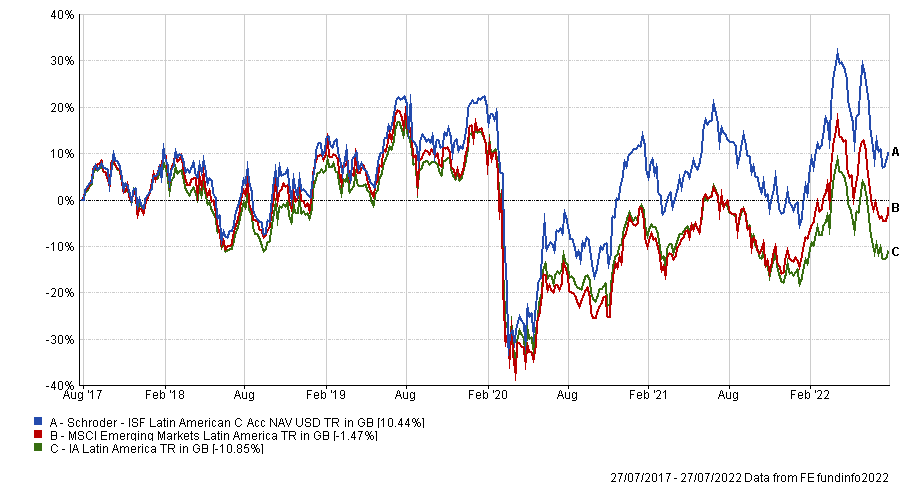

One of the only two portfolios to make a positive return over the period was the Schroder ISF Latin American fund, which gained 10.4% in the past five years.

Regionally, the fund is close to that of the benchmark, with the vast majority (87.4%) of assets held in Brazil or Mexico.

It is perhaps the two overweight positions in energy and industrials, two sectors that have performed well in this high inflationary environment, that have boosted the fund’s returns above the rest of the sector – they accounted for 26.9% of assets, compared to the MSCI EM Latin America index’s 18.6%.

Total return of fund vs sector and index over 5yrs

Source: FE Analytics

The only other portfolio to make a positive return was Barings Latin America, which is up 3.7% over the past five years.

It wasn’t the best performer, but its 1% fee meant that it scraped below the average sector price.

The Schroder ISF Latin American fund, on the other hand, charged an above average 1.32%, but some investors might be willing to dish out more on its high alpha of 2.8.

| Fund | OCF | Alpha | Info ratio | Total return |

| HSBC MSCI EM Latin America UCITS ETF | 0.6% | -1.1 | -0.4 | -6.6% |

| Barings Latin America | 1% | 1.1 | 0.2 | 3.7% |

| Schroder ISF Latin American | 1.32% | 2.8 | 0.4 | 10.4% |