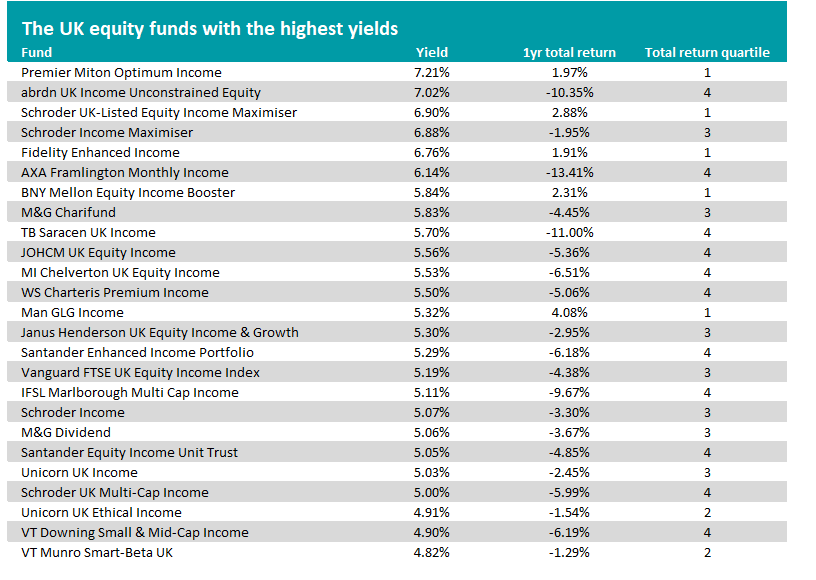

There is no shortage of UK equity funds that are yielding more than the market at present, although investors should double-check the total return of the highest yielders as some have been hit with heavy falls recently.

Investors are becoming more interested in income as inflation remains elevated and worries about a recession persist, leading to growing attention on equity income funds.

The FTSE All Share is currently yielding 3.74% but there are 70 members of the IA UK Equity Income and IA UK All Companies funds with a higher yield than the index.

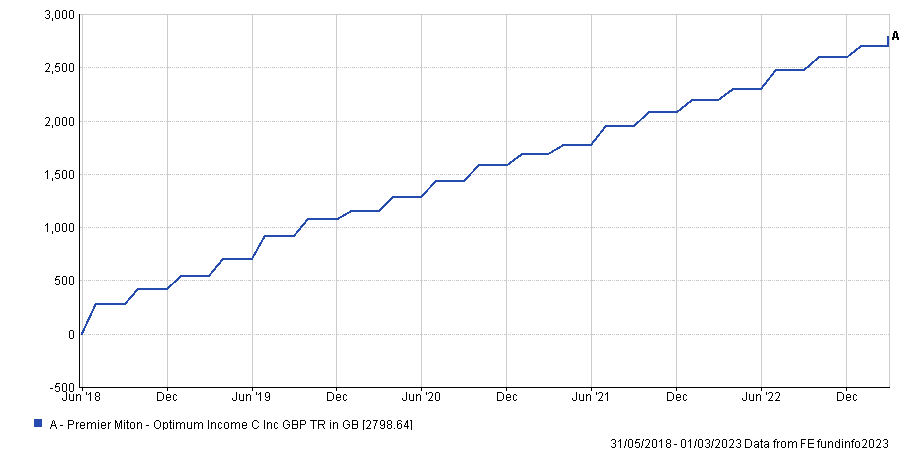

Income paid by Premier Miton Optimum over 3yrs

Source: FE Analytics

As would be expected, ‘enhanced income’ funds are at the top of the list. Premier Miton Optimum Income has a 7.21% while Schroder UK-Listed Equity Income Maximiser (6.90%) and Schroder Income Maximiser (6.88%) are close behind.

These funds invest predominantly in dividend-paying stocks, using strategies such as covered call options to boost income. Covered calls involve selling call options on stocks that the fund owns that essentially exchanges some capital upside for higher income; the premium received from selling these options can significantly boost the fund's income.

In addition to having the highest yield, Premier Miton Optimum Income has performed pretty well from a total return point of view recently as well – its 2% gain over the past 12 months puts it in the top quartile of the IA UK Equity Income sector.

As the chart above shows, an initial investment of £10,000 made into the fund five years ago would have resulted in income payouts of just under £3,000.

The 25 UK funds with the highest yields can be seen below, along with their total return over the past 12 months. All are from the IA UK Equity Income sector.

Source: FE Analytics

The conventional UK equity fund with the highest yield at the moment is abrdn UK Income Unconstrained Equity. It has a yield of 7.02% and has paid out £1,700 on an initial investment of £10,000 made five years ago.

The £378m fund aims to generate a yield higher than the FTSE All Share over rolling five-year periods as well as outperforming on total return. The ‘unconstrained’ approach means the fund might hold more in the small- and mid-cap spaces than a traditional UK equity income portfolio; over the past year, it has been investing in companies that could benefit from the inflationary backdrop.

However, it has lost 10.4% over the past year, which is one of the worst results of the IA UK Equity Income sector and could partly explain why its yield is so high.

Yield is calculated by dividing the value of income payouts over the past year by the current share or unit price of an asset. This means that a high yield can be the result of a high dividend or falling capital value.

Indeed, many of the funds noted above for their high yields have produced some of the lowest returns over the past year. Alongside abrdn UK Income Unconstrained Equity in the bottom quartile are another 10 funds including AXA Framlington Monthly Income, JOHCM UK Equity Income, MI Chelverton UK Equity Income and IFSL Marlborough Multi Cap Income.

Just five of the funds on the list above are in the top quartile for total return over the past 12 months and four of them are enhanced income strategies: Premier Miton Optimum Income, Schroder UK-Listed Equity Income Maximiser, Fidelity Enhanced Income and BNY Mellon Equity Income Booster.

The remaining conventional fund is Man GLG Income, which is run by FE fundinfo Alpha Manager Henry Dixon. It has a yield of 5.32% and over the past five years has paid out £2,325 on an initial £10,000 investment.

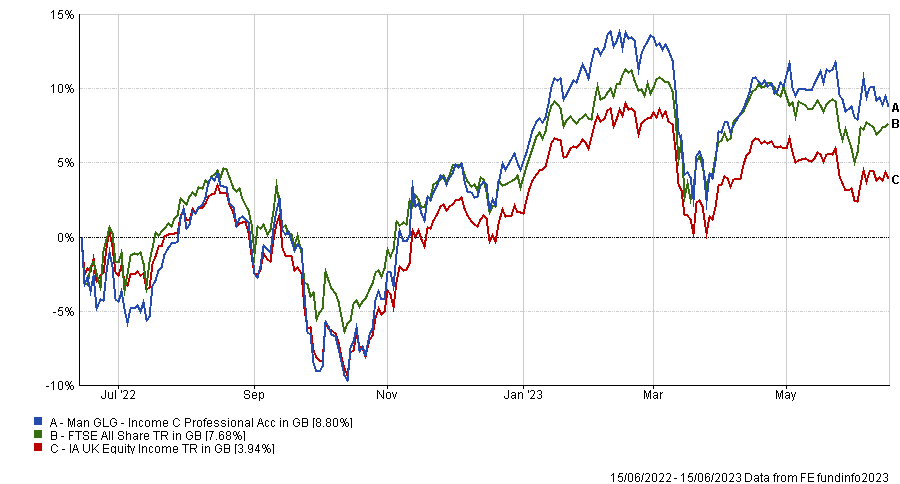

Total return of Man GLG Income vs sector and index over 1yr

Source: FE Analytics

Dixon is a value investor and this style has come back into style over recent years after an extended period of underperformance. That said, the managers has a strong track record even when value was lagging behind and his fund is top quartile in the IA UK Equity Income sector over one, three, five and 10 years despite some periods of underperformance.

Analysts at FE Investments said: “The fund has typically outperformed its peers and the UK equity market thanks to strong stock-selection and income generation. Underperformance in 2016 was attributable to the fund’s bias to mid-sized companies, which sold off-post Brexit referendum. This exposure, along with strong stock selection made for significant outperformance afterwards.”