Investors have scrambled to buy technology exposure this year as the transformative powers of artificial intelligence (AI) become increasingly apparent.

Since the release of ChatGPT brought AI into the mainstream consciousness and highlighted its long-term growth potential, markets have upped valuations on leading AI companies massively.

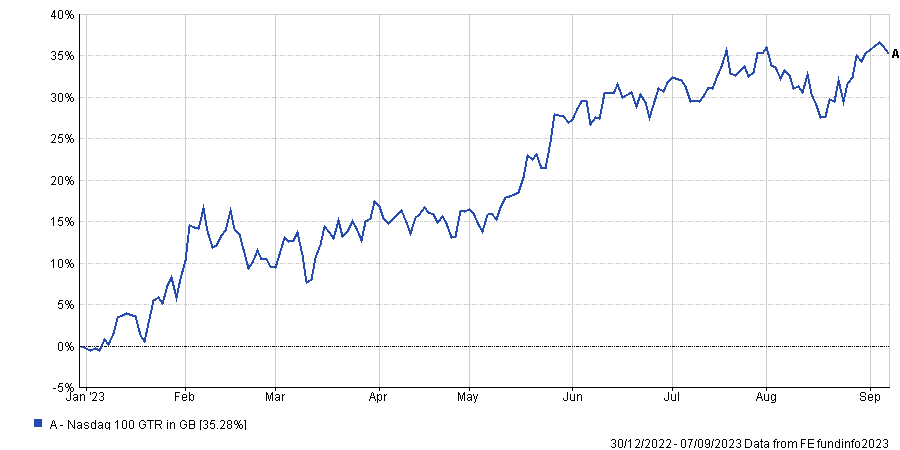

Seven companies that were early adopters of AI – Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, Tesla – accounted for the vast majority of the Nasdaq 100’s 35.3% rebound this year.

Total return of Nasdaq 100 index over YTD

Source: FE Analytics

Source: FE Analytics

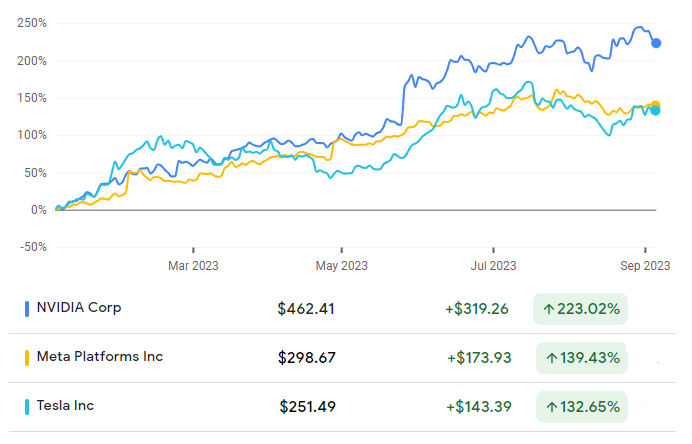

Some of the most popular stocks soared well ahead of the market, with the likes of Nvidia, Meta and Tesla rising 223%, 139.4% and 132.7% respectively in 2023.

Many investors clearly want exposure to these high gains but with so many funds claiming to benefit from the AI revolution it may be confusing to know where to start.

Below, Trustnet asked expert fund pickers for three different routes to buying AI, whether it be through a passive, thematic or broader equity fund.

Share price of stocks in 2023

Source: Google Finance

Passive specialists

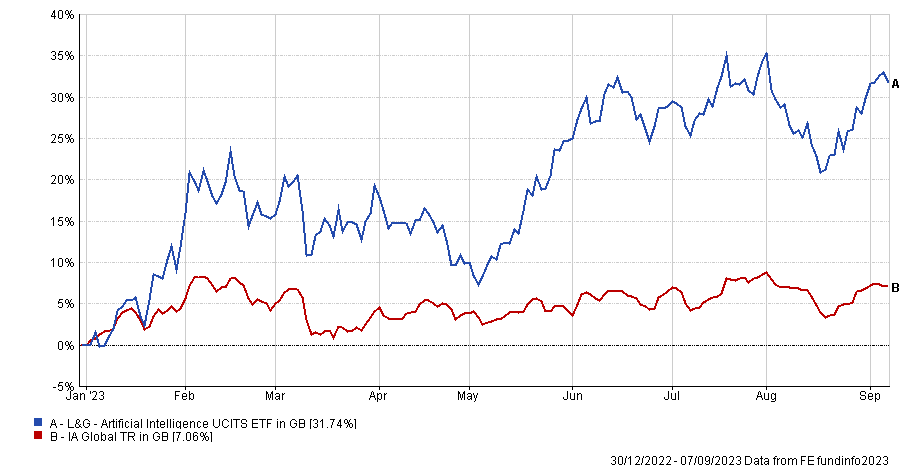

Those wanting to take perhaps the most direct route and simply track the top AI companies may want to consider the Legal & General Artificial Intelligence ETF, according to Fairview Investing co-founder Ben Yearsley.

It tracks the ROBO Global Artificial Intelligence Index, which is made up of 65 names that are ranked on their “level of revenues and investments in artificial intelligence activities, as well as market and technology leadership in the field of AI”.

This methodology may only include top AI names, but Yearsley said the index is “surprisingly more diverse” than many would expect.

Technology makes up the majority of sector allocations at around 72.2%, but it also has exposure to areas such as consumer discretionary (11%) and healthcare (5.3%).

Indeed, only three of the ‘magnificent seven’ who led the Nasdaq 100 this year – Nvidia, Alphabet and Microsoft – are in the fund’s top 10 holdings.

By investing in this diverse group of stocks, the Legal & General Artificial Intelligence ETF has risen 31.7% so far this year, 24.7 percentage points ahead of the average IA Global fund.

Total return of fund vs sector in 2023

Source: FE Analytics

Source: FE Analytics

Without active management fees, passive funds tend to be a cheaper option for investors, but Yearsley pointed out that Legal & General’s charges of 0.49% is on the higher end.

He said: “The ongoing charges figure isn’t the cheapest – I’m not sure why it needs to be so expensive if I’m honest.”

Active specialists

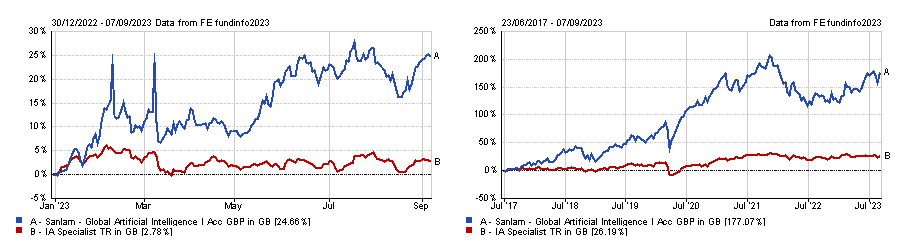

Alternatively, investors who would rather have a management team hand selecting a set of the best AI companies might want to look at Sanlam Global Artificial Intelligence, according to FundCalibre managing director Darius McDermott.

Managers Chris Ford and Tim Day have created a portfolio of 43 companies from around the globe that they deem to be the biggest long-term beneficiaries of AI.

Top allocation include some of 2023’s biggest winners, with Nvidia, Alphabet, Microsoft and Tesla accounting for a fifth of the fund.

However, if Yearsley found the L&G tracker diversified sector-wise, the Sanlam fund may be even more so, with less than half (46.5%) of its holdings in the tech sector.

The £737m portfolio was up 24.7% in the 2023 rally, but its track record dates back further beyond this year’s excitement. Since launching in 2017, Sanlam Global Artificial Intelligence is up a sizable 177.1%.

Total return of fund vs sector since launch

Source: FE Analytics

Source: FE Analytics

General tech

Investors who want a broader exposure to wider themes in the technology sector might want to look into Charles Stanley fund researcher Adam Carruthers’ pick – Polar Capital Global Technology.

He said the $5.2bn portfolio has some excellent exposure to some of the companies with the biggest potential for AI disruption, especially given that long-term manager Ben Rogoff (who has run the fund since 2006) has been allocating towards the theme for many years.

However, the Polar Capital Global Technology fund has a wide investment universe that captures growth themes in the sector beyond just AI.

By doing so, analysts at Square Mile anticipate the fund could outperform the Dow Jones World Technology index by 2 percentage points a year.

Over the past decade, it made a total return of 458.3%, some 139.9 percentage points higher than the IA Technology & Technology Innovation sector average.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

Source: FE Analytics

Researchers at Square Mile added: “The fund is managed by experienced investors who are skilled in identifying changing industry trends and the companies that are poised to benefit as a result.

“Technology is constantly evolving and continued vigilance is required by the managers to keep informed of developments.”