Money market funds and cash deposits have had a comeback since the monetary cycle turned hawkish and pushed cash yields to highs not seen for decades.

With cash accounts returning north of 5%, more defensive investors might be asking themselves if it still makes sense to be allocating to income funds that provide similar yields to cash but have an added level of risk.

Income-focused managers like FE fundinfo Alpha Manager Richard Saldanha, who runs the Aviva Global Equity Income fund (currently yielding 2.6%), recognise it’s a valid question to ask, but point out that, with pure cash, investors miss out on two crucial things – capital and dividend growth.

“Higher cash yields are attractive but investing in companies that can deliver close to double-digit compounding returns is another thing. The first argument is the deliberate capital growth you’d be missing out on,” Saldanha said.

“Then there’s yield growth. A 5% yield is great, but if you're not growing it, inflation is going to start eroding your returns quite quickly. Investing in yields that grow is crucial for people that are thinking long term, such as saving for their kids’ education or for retirement.”

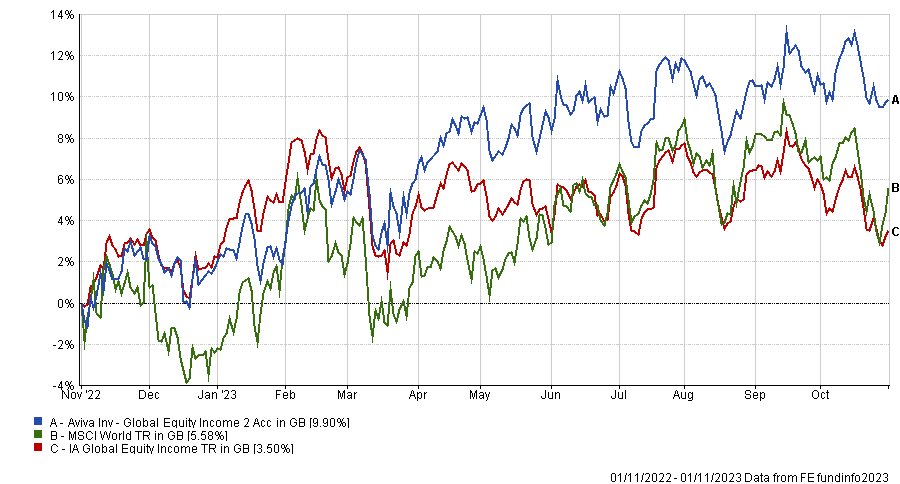

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Fidelity International’s multi-asset manager George Efstathopoulos also made a similar point, but highlighted that the two options aren’t mutually exclusive.

“Given the heightened chance of a recession and the attractive cash yields, we would indeed recommend investors holding some cash in their portfolios. The liquidity will do fine in the short term, but favouring it blindly over funds provides a false sense of security. Cash might be a good place to hide, but it is not a good place to stay,” he said.

“Anyone with an investment horizon longer than a few years must balance the desire for yield with the need for growth in order to counteract inflation, as well as the flexibility and diversification required to generate steady income through time.”

On balance, therefore, he also recommended income funds over cash, citing several reasons as to why, starting with the fact that yields change over time across asset classes, which might seem obvious but is easy to forget.

“Natural income generated by individual asset classes can fluctuate significantly across cycles due to factors that can be hard to predict (in recent years, notably the economically motivated activity of central banks),” Efstathopoulos said.

“Relying on a single asset class for income is therefore a risky strategy, and particularly so for investors with longer time horizons (for example, those taking regular income through retirement). Current yields on cash and other low-risk assets may provide a false sense of security when it comes to generating income over multiple market cycles.”

To everyone that has bought Royal London Short Term Money Market or other money market funds (the Royal London vehicle was particularly popular in October, when it ousted Fundsmith Equity as the most bought fund on interactive investor), Efstathopoulos said, with yield curves as inverted as they are today, it is worth bearing in mind that these instruments mature and need to be reinvested constantly, potentially at much lower yields than can be achieved today.

“A portfolio based only on present yields without the flexibility to move across asset classes is unlikely to deliver stable income over the long term,” he added.

Another problem with relying purely on cash and low-risk assets for income is that “they cannot provide growth to tackle inflation”, meaning the total value of a portfolio (and the income generated from it) will fall in real terms over time, as Saldanha also noted.

“We believe we are entering a period of structurally higher inflation, which will force investors to think carefully about the long-term growth of capital as well as the income it generates,” he said.

“Cash and other low-risk assets currently offer decent levels of yield so it is understandable that some income-seeking investors may decide to allocate more here, but diversification will remain as important as ever and multi asset strategies can also take advantage of this while at the same time providing opportunities for growth to combat inflation.”