Japan’s equity market has been on a tear so far in 2023 on the back of a value rally but experts are mixed on whether this will continue or if a reversal of fortunes could be in order.

This leaves investment managers and fund selectors with myriad questions, such as will large-caps keep rising or will smaller companies take the lead, if corporate governance reform will fuel growth and what will happen with a plummeting yen?

Rather than trying to answer all these questions and pick one fund to do everything, experts recommended combining a variety of investment strategies in this difficult-to-time market. Pairing up offsetting styles should guard against the risk of missing out, whilst also providing some protection against slumps.

As Darius McDermott, managing director of Chelsea Financial Services, explained: “We tend to see a huge dispersion in performance between different Japanese funds because of the magnified effects of style and currency in this market. You will often see violent swings in performance as different styles go in and out of favour. A sensible strategy is to own a combination of different styles so you don't get caught out.”

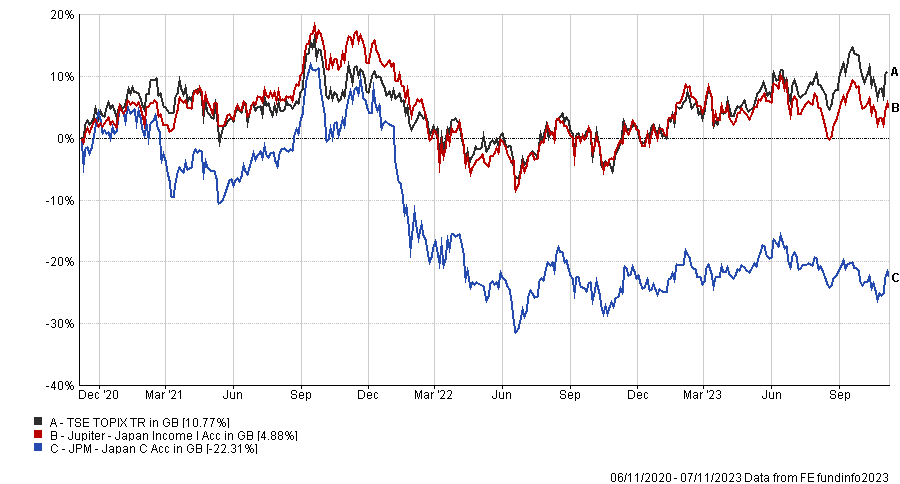

JPM Japan and Jupiter Japan Income

Bestinvest managing director Jason Hollands suggested investors should go with two funds that each offer a different approach – one that prefers to go for out-and-out growth and the other investing with an income tilt.

“The JPM Japan fund is very much a growth strategy, which is heavily overweight technology versus the wider market. In contrast, Jupiter Japan Income offers a more balanced approach in terms of style,” he explained.

JPM Japan is managed by Tokyo-based Nicholas Weindling, Miyako Urabe and Shoichi Mizusawa who look for companies poised to tap into long-term structural trends such as digitalisation and the fund is heavily overweight technology.

Jupiter Japan Income is run by Dan Carter and Mitesh Patel, who invest in high‑yielding businesses that possess competitive advantages, with a bias towards small and mid-cap growth stocks.

Performance of funds vs benchmark over 3yrs

Source: FE Analytics

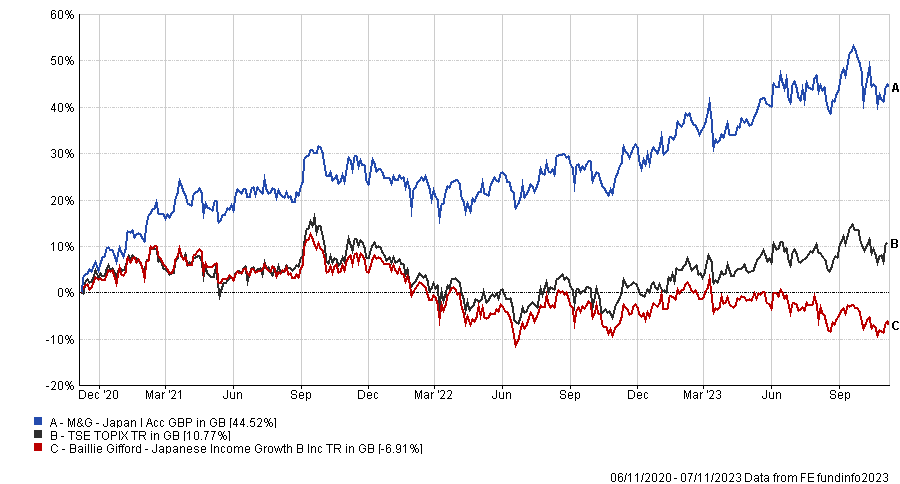

M&G Japan with Baillie Gifford Japanese Income Growth

Quilter Investors also chose a growth and a value manager. It invests with Baillie Gifford, which pursues a long-term quality/growth approach, alongside M&G Japan, which has a modest value tilt and is managed by Carl Vine.

On the latter, CJ Cowan, a portfolio manager at Quilter Investors, said: “The team puts a lot of focus on corporate engagement and being an active shareholder to help shape the direction of portfolio holdings. This process has led to strong and consistent performance throughout Vine’s tenure managing the fund.”

Since he took charge in 2019 the fund has made 37.6%, more than double the IA Japan sector average of 15.4% – a top-decile effort among its peer group.

Alongside M&G Japan, Quilter holds the Baillie Gifford Japanese Income Growth fund, which “invests a little further down the market cap looking for growth style companies, although the income objective helps the managers maintain their valuation discipline and stops them chasing overoptimistic growth stories,” Cowan explained.

“We are attracted to their proven ability to pick long-term winners. While performance this year has been challenging, this is largely explained by style factors as large-cap value stocks have led the market while mid-cap growth has underperformed.”

Managed by Matthew Brett since its launch in 2016, the fund has made 46.4%, slightly behind the sector average (58.4%) as the style has been out of favour.

Performance of funds vs TOPIX over 3yrs

Source: FE Analytics

Three is not a crowd

Ben Yearsley, co-founder of Fairview Investing, recommended taking on exposure to all parts of the market and recommended three funds to achieve that.

“Buy large-cap, have a bit of growth or GARP [growth at a reasonable price] and add some more niche small-cap value plays as well,” he said.

To do this, he chose Man GLG Japan Core Alpha for large-caps, Zennor Japan for growth and the AVI Japan Opportunity Trust for small-cap value.

-

Growth and quality over value

Although McDermott recommended building a portfolio with a combination of styles, he thinks this might be a good time to trim large-cap value exposure and pivot into growth strategies, which have underperformed lately. “Large Japanese value businesses benefit from a weaker yen as this boosts their overseas earnings. We would be minded to fade this after a strong run for large-cap value,” he explained.

He owns the Baillie Gifford Japan trust in his multi-asset portfolios, which has been a poor performer recently as its bias to growth and some small-caps has hurt it.

“We also like Comgest Growth Japan and FSSA Japan Focus, which are both quality growth focused trusts which have struggled in the current environment,” he said.

McDermott also highlighted the Baillie Gifford Shin Nippon trust as a small-cap option, despite having “a very tough time of late”.

“The stocks in the portfolio have now de-rated to such an extent that they are trading on the same multiple as the market but with far better growth. The last time this happened was in 2008,” he pointed out.

Performance of growth funds over 3yrs

Source: FE Analytics