Investors wanting to nab the biggest bargains should look to the US or UK market, where they can pick up funds for pennies, according to data from FE Analytics.

Keeping costs down is just one aspect investors should consider when putting their money into a fund, but it is a crucial one.

Assuming no investment returns, investing £100 in a fund charging 0.5% would leave an investor with £90.46 after 20 years. Doubling this to a 1% fee leaves an initial £100 pot at £81.79, while doubling the charge one final time to 2% would leave just £66.76 – roughly a third lower.

Most funds charge less than 1%, but by the time platform charges, transaction costs and potential advice costs are taken into account, this latter figure is easily hit.

Of course, portfolios that incur higher charges often do so under the promise of superior investment returns. Yet beating the market is by no means a guarantee and the higher the fees, the more a fund needs to outpace its rivals to make the same total return.

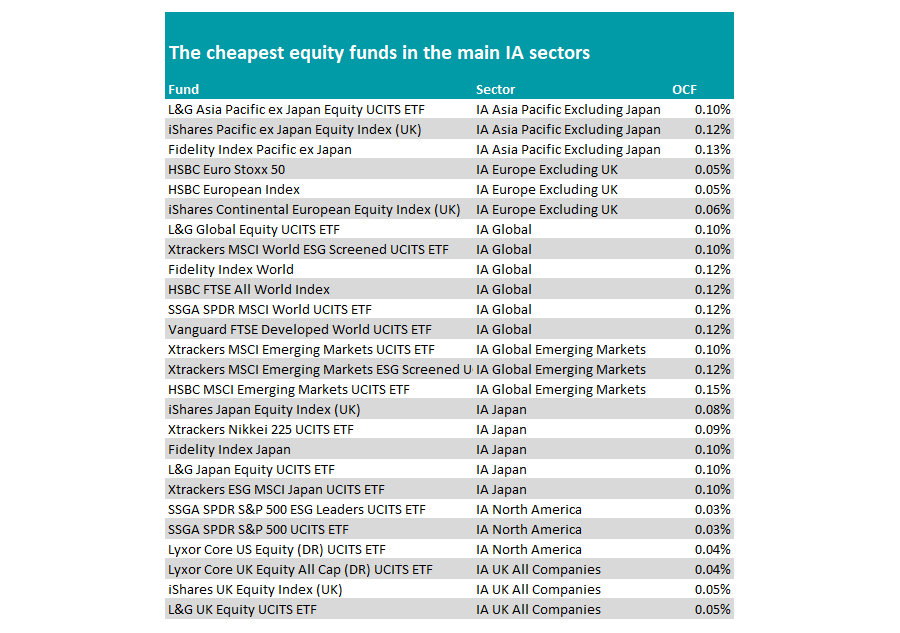

For those that wish to track the market for the lowest cost, below Trustnet has highlighted the least expensive options in each of the main Investment Association equity market sectors.

The joint cheapest options among all funds on the list are the $2.1bn SSGA SPDR S&P 500 ESG Leaders UCITS ETF and $9.4bn SSGA SPDR S&P 500 UCITS ETF, which has an ongoing charges figure (OCF) of 0.03% per year. Please note this is does not include platform and transaction costs.

The former is an environmental, social and governance (ESG) tracker that aims to match the performance of the S&P 500 ESG Leaders Index, while the latter is a more traditional S&P 500 index tracker. Lyxor Core US Equity (DR) UCITS ETF came in third place in the sector, just one basis point higher with a charge of 0.04%.

Source: FE Analytics

With the same cost, the cheapest fund in the IA UK All Companies sector is Lyxor Core UK Equity All Cap (DR) UCITS ETF. The £3456m tracker aims to replicate the Morningstar UK benchmark.

The £10.8bn iShares UK Equity Index (UK) is in joint second. It is the only one of the three cheapest options to track the FTSE All Share and charges 0.05%, while the £98.1m L&G UK Equity UCITS ETF has the same cost but follows the Solactive Core United Kingdom Large & Mid Cap index.

The IA Europe Excluding UK sector is the next cheapest, with HSBC Euro Stoxx 50 and HSBC European Index costing just 0.05%, while investors looking further afield can snap up iShares Japan Equity Index (UK) or Xtrackers Nikkei 225 UCITS ETF in the IA Japan sector for OCFs 0.08% and 0.09% respectively.

Conversely, the costliest areas to invest are IA Global, IA Asia Pacific Excluding Japan and IA Global Emerging Markets, where the cheapest funds in the sector will set investors back 0.1%, triple the cheapest US tracker and more than double their UK counterparts.

These areas of the market are harder to research and wider in remit, which could be one explanation for their higher fees.

Another sustainable option – Xtrackers MSCI World ESG Screened UCITS ETF – is the most cost-effective global tracker alongside L&G Global Equity UCITS ETF.

Meanwhile, L&G Asia Pacific ex Japan Equity UCITS ETF is the cheapest Asia fund, while Xtrackers MSCI Emerging Markets UCITS ETF is the most cost-effective option among emerging market portfolios.