Technology stocks powered ahead while healthcare companies were left languishing behind in May as markets continued to be dominated by the whims of US president Donald Trump.

Last month was a relatively strong one for equity markets up until Trump announced negotiations with the European Union were not moving forward and suggested imposing 50% tariffs on the bloc from the start of June.

There was even more turmoil last week when a panel of judges in the US ruled the tariffs illegal, potentially putting the kybosh on the US president’s aggressive trade policy.

The US government is likely to either appeal or look for alternative ways to force through its agenda, according to experts, but Ben Yearsley, director at Fairview Investing, said there was a clear trend to the tariffs: “Backtracking leads to markets rising, tough talk and markets fall”.

It was far from the only US story last month, with government bond markets firmly in the crosshairs after ratings agency Moody’s downgraded US credit. US 10-year treasury finished last week paying 4.4%, up from 4.16% at the start of May.

Meanwhile, although the UK wasn’t downgraded last month, government borrowing unexpectedly rose to £20bn in April and borrowing in the year to 31 March 2025 was £11bn higher than forecast.

The UK 10-year gilt had a similar move to its US counterpart. It offered 4.44% at the start of May but ended last week with a yield of 4.65%.

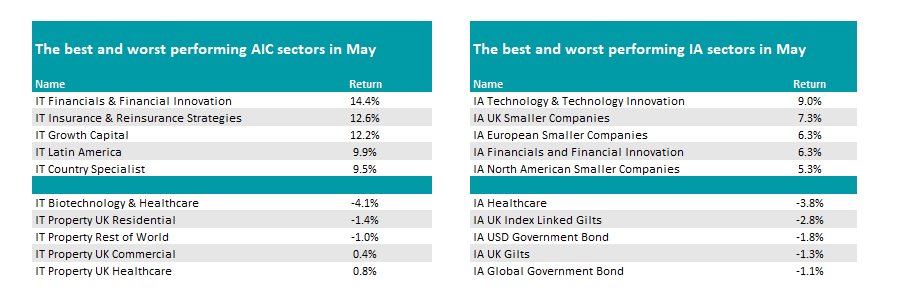

Both the UK and US bond sectors were among the worst-performing Investment Association peer groups last month, representing four of the five biggest fallers, as the table below shows.

Source: FE Analytics

The worst, however, was the IA Healthcare sector, where funds dropped 3.8% on average. Trump signed a new executive order aimed at lowering US drug prices by requiring pharmaceutical manufacturers to match the lower prices in other high-income countries.

Janus Henderson research analyst Luyi Guo said: “Under the proposed ‘most-favoured nation’ policy, if a prescription costs $50 in the US but only $20 in another developed country, the US government would tell the drugmaker it is only willing to pay $20 for that drug.

“Overall, while we are encouraged by Trump’s moderately more constructive tone on the proposed policy, we recognise the risks it poses in its current form. Broad drug pricing controls could reduce funding, slow innovation, and put jobs at risk – not to mention threaten the United States’ global leadership position in this vitally important industry.”

It was not all bad news, however. Smaller companies did well, with UK small-caps, European small-caps and North American Smaller Companies all featuring in the top five sectors.

Yearsley said: “The Mansion House Accord possibly helped UK smaller companies with rumours abounding about a large allocation to UK small-caps in the near future."

The top of the pack was the IA Technology & Technology Innovation sector, up 9%. Although this was below the returns made by the tech-heavy Nasdaq index, Yearsley said a strong pound was a headwind for UK investors.

Strong results from market darling Nvidia helped tech stocks in May, as did a month of relatively sanguine news from the White House.

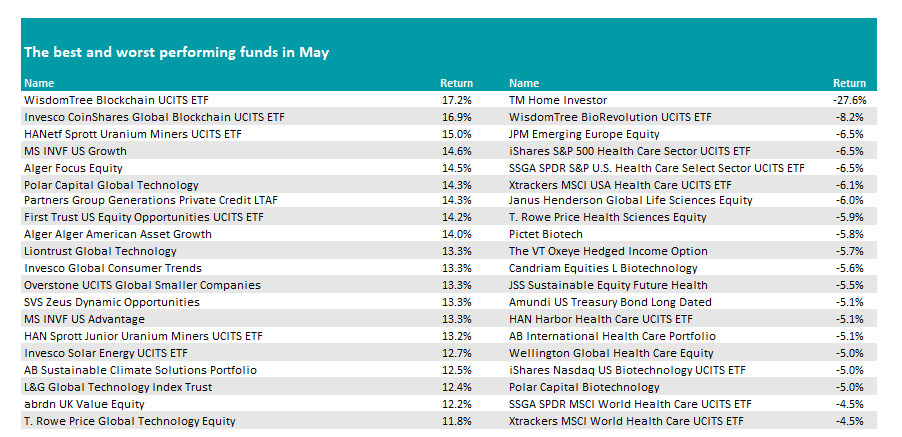

Tech funds were well represented in the top-performing individual funds over the past month, which included the likes of Polar Capital Global Technology and Liontrust Global Technology.

Source: FE Analytics

WisdomTree Blockchain UCITS ETF and Invesco CoinShares Global Blockchain UCITS ETF were the top two performers, up 17.2% and 16.9% respectively.

At the foot of the table, healthcare funds were well represented with both active and passive strategies littering the bottom 20 performers, with more than three-quarters of the list taken up by biotechnology and pharmaceuticals specialists.

JPM Emerging Europe Equity was also notable, said Yearsley, as “hopes of an imminent ceasefire and end to hostilities in Ukraine faded”.

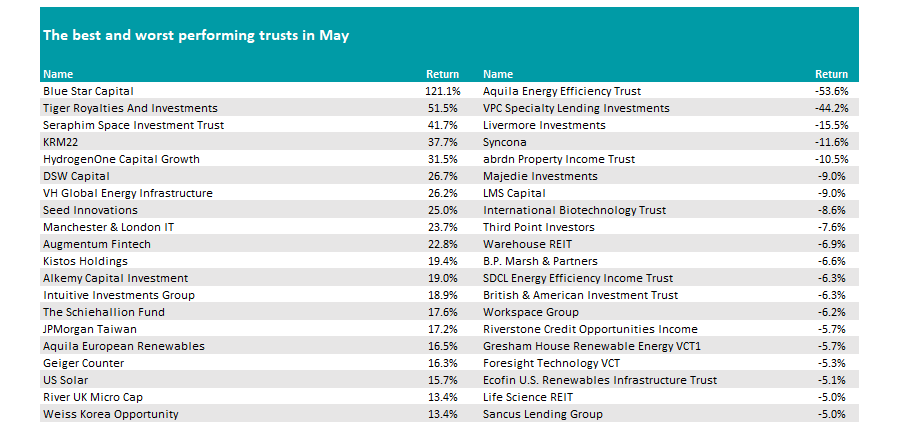

Turning to investment trusts, there were no new takeovers last month but Blue Star Capital shot higher, up 121%, as one of its holdings – SatoshiPay – announced strong transactions on its payments platform Vortex. The trust has a 27% stake in the company.

Source: FE Analytics

Seraphim Space Investment Trust also did well, up 41.7%, as its satellites have been playing an increasingly important role in the war between Russia and Ukraine.

Interactive investor’s Ian Cowie said: “Monday’s decision by Friedrich Merz, the German chancellor, to back Ukrainian missile strikes even deeper into Russian territory helped propel the price higher.”

Yearsley also highlighted that several infrastructure trusts had performed better last month, which he attributed to forecast interest rate cuts. These should “help the embattled infrastructure sectors”, he noted, adding “there did seem signs of life”. IT Insurance & Reinsurance Strategies was the second-best performing Association of Investment Companies (AIC) sector in May.

On the downside, Aquila Energy Efficiency Trust led the biggest losers. It was one of a number of trusts in managed wind-downs, which skewed the results. This includes abrdn Property Income.

Trusts in wind-down sell and return the cash to shareholders, making it look as though the net asset value has reduced, even though shareholders have not lost out.