Investors continued to favour broad, low-cost exposure when buying global equity funds in 2025 while some of the UK’s largest and best-known active global strategies struggled to stem persistent outflows – first among them the once-popular giant Fundsmith Equity.

Using FE Analytics’ Market Movements tool, Trustnet examined the unit trusts and OEICs within the IA Global sector to identify the funds that attracted or lost the most money over the year.

Index strategies captured investors’ interest

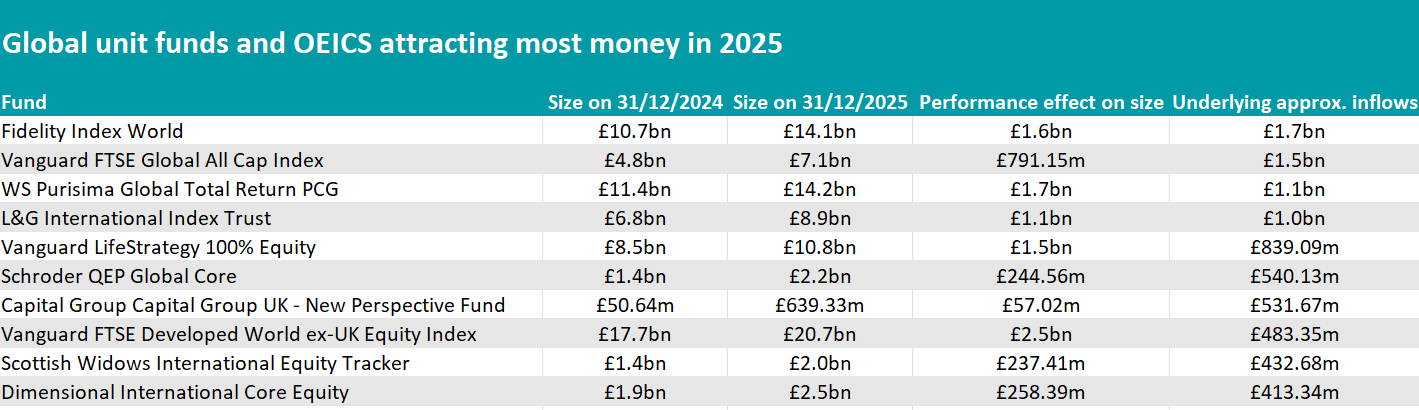

The most significant inflows were concentrated in large, diversified global index funds, reflecting investors’ preference for simple, broad-based exposure. Data from Calastone earlier this month revealed that passive global equity funds were more popular than active ones in 2025 for the first year since 2015.

Source: FE Analytics

Fidelity Index World attracted the largest net inflows of the year, with investors adding approximately £1.7bn. Combined with a £1.6bn performance contribution, assets rose from £10.7bn to £14.1bn over the 12 months.

Vanguard FTSE Global All Cap Index followed closely behind, with £1.5bn of net new money and £791m from performance, lifting assets from £4.8bn to £7.1bn. L&G International Index Trust also featured prominently, taking in just over £1bn of inflows alongside a £1.1bn performance boost.

Other names included Vanguard FTSE Developed World ex-UK Equity Index (which added £483m of investors’ money), HSBC FTSE All World Index (£313m) and a few environmentally, sustainability and governance (ESG) funds, such as Fidelity Index World ESG Screened (£349m), HSBC Developed World Lower Carbon ESG Tilt Equity Index (£226m) and L&G Future World ESG Tilted and Optimised Developed Fossil Fuel Exclusions Index (£250m).

Strictly not a passive fund but a mixed-asset portfolio of trackers, the ever-popular Vanguard LifeStrategy 100% Equity drew £839m of inflows, while BlackRock Consensus 100 added £84m.

Selective support for active global funds

While passive funds dominated overall inflows, a number of active global equity strategies also attracted meaningful investor support.

WS Purisima Global Total Return was the only active fund to take in over £1bn of new money, with performance contributing a further £1.7bn and pushing assets above £14bn.

Orbis Global Equity added £228m of investors’ money. It is a fund with a maximum FE fundinfo Crown rating of five which emerged in 2025 for making it to the top without owning any Magnificent Seven stocks in its top 10.

WS Blue Whale Growth attracted £142m. It is run by FE fundinfo Alpha Manager Stephen Yiu, who focuses on companies that have a moat, strong quality characteristics and the ability to grow their profits at a faster rate than the market believes.

RSMR analysts highlight the fund for being more diversified than it has been previously, and for Yiu’s ability in identifying changing investment regimes and pivoting to those companies best placed to take advantage of incoming change.

Artemis SmartGARP Global Equity took in £98m. Led by Alpha Manager Raheel Altaf, it belonged to the list of funds that investors couldn’t stop looking at in 2025.

Heavy redemptions from large franchises

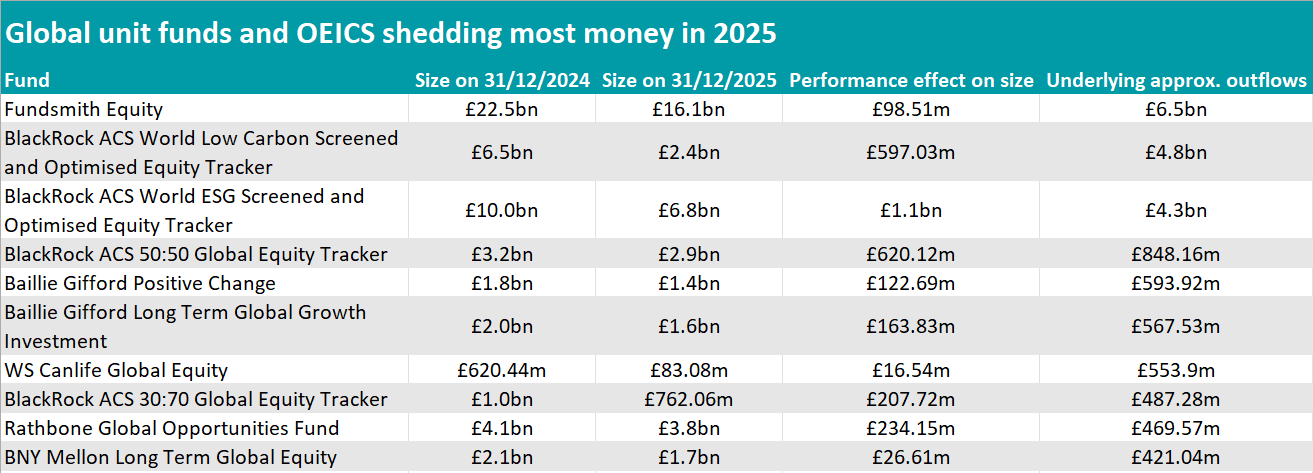

On the sell side, the scale of withdrawals from several flagship global equity funds was far larger than the inflows seen elsewhere.

Source: FE Analytics

Fundsmith Equity was the most heavily sold fund, shedding £6.5bn over the year. While performance added a small £99m, assets fell from £22.5bn to £16.1bn.

Veteran Alpha Manager Terry Smith’s quality-growth strategy, with its heavy exposure to US equities and healthcare stocks, struggled in 2025 as American markets lagged global peers and healthcare faced regulatory and pricing headwinds, resulting in the fund’s first bottom-quartile calendar-year return and extending a run of underperformance versus the sector average since 2022.

Other high-profile active strategies also struggled to retain assets. Baillie Gifford Long Term Global Growth (£568m outflows), Baillie Gifford Positive Change (-£594m) and Baillie Gifford Global Alpha Growth (-£367m) all saw substantial withdrawals, even though several delivered positive absolute returns in 2025.

The list of sustainable and impact-focused global funds also included Liontrust Sustainable Future Global Growth, which lost £348m, Janus Henderson Global Sustainable Equity (-£306m) and Ninety One Global Environment, which saw £297m leave the fund. In many cases, performance gains softened but did not offset investor withdrawals.