There are two parts to a bond’s return: the coupon paid each year and the price of the asset, which changes over time.

Recently, bond prices have been falling as central banks have hiked interest rates aggressively.

Perhaps more so than in any other sector, when it comes to bonds, investors need a fund that can combine the coupon payment with capital appreciation.

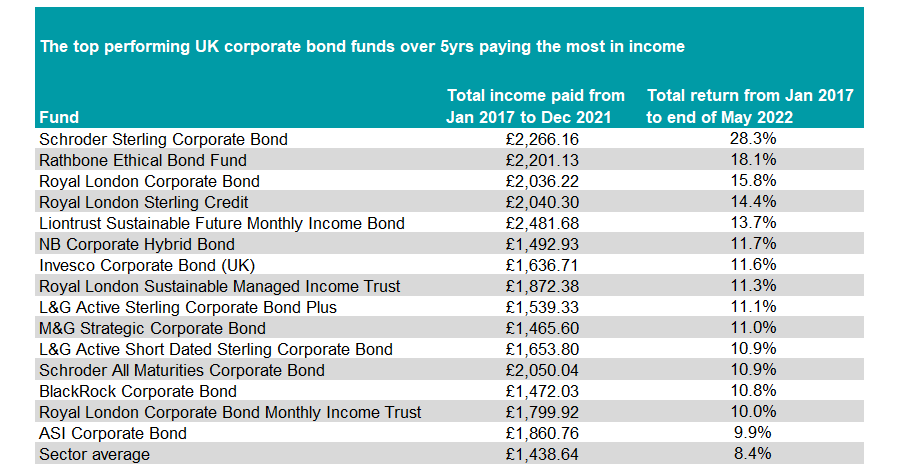

In this series, Trustnet looks at the total amount of income paid on an initial £10,000 investment made at the start of 2017 to the end of 2021.

We then looked at the total returns of these funds from January 2017 until the end of May 2022 to show those that have managed to make money from capital returns as well, filtering out those that have failed to land in the top 25% of their sector.

Previously, we have looked at the IA UK Equity Income, IA Global Equity Income, IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors, as well as IA Sterling Strategic Bond.

Source: FE Analytics

Top of the pile is the five FE fundinfo Crown-rated Schroder Sterling Corporate Bond fund, managed by Daniel Pearson and Julien Houdain since the start of 2021. Former manager Jonathan Golan left last year.

The fund is 55% weighted to the UK, with the remainder in overseas bonds. It has overweight positions in industrials and financials.

It mainly operates on the cusp of investment grade and high yield, with the majority of the portfolio in BBB-rated bonds.

As such, it has paid out a healthy £2,266.16 in income over the past five years, while making a total return of 28.3%, the highest figure in the 91-fund sector.

Up next is the five-crown rated £2.4bn Rathbone Ethical Bond fund, managed by Bryn Jones, which focuses primarily on income generation. This helps to explain the above-average £2,201.13 paid out on £10,000 over five years.

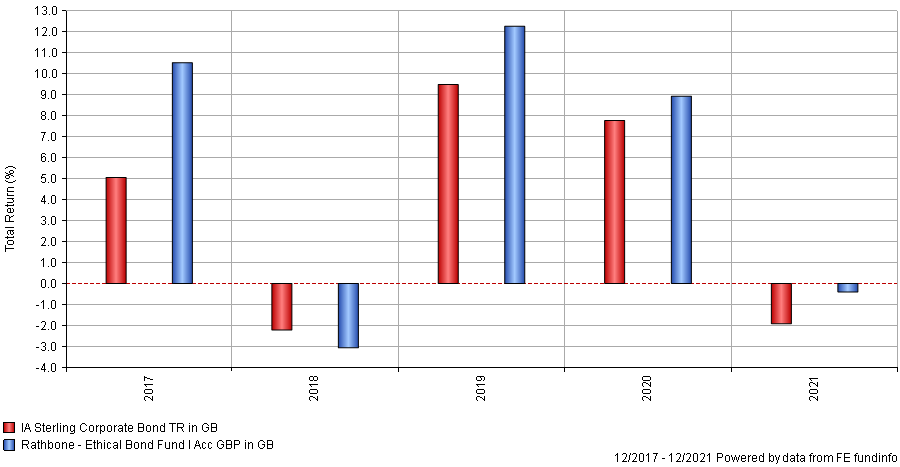

Analysts at Square Mile Research & Consulting said the fund’s manager uses both positive and negative screens, as well as implementing a high beta approach. This means it should do well when the credit market rises, but poorly when it falls.

For example, in 2019 when markets were more accommodative, the portfolio made a top-quartile return. It also held up well last year, but has made a larger-than-average loss in 2022 so far.

Total return of fund vs sector in each of the past five calendar years

Source: FE Analytics

“This fund is actively managed and we find the investment team credible both on the investment and responsible sides. This is one of the few funds within the sector that holds a long-term track record of running money in a responsible manner whilst outperforming on a consistent basis,” said the analysts at Square Mile.

Another fund with an environmental, social and governance (ESG) angle is the £465m Liontrust Sustainable Future Monthly Income Bond fund, managed by Stuart Steven, Kenny Watson, Aitken Ross and Jack Willis.

It has paid out the most on the list (£2,481.68), while making a 13.7% total return overall in the past five years.

Analysts at Square Mile said that this is a fund “with a conscience”. Focusing on sustainability matters, it invests in the bonds of businesses that produce goods or services that benefit the environment or society.

“This focus on sustainability is not, however, at the expense of sound investment principles. The team are all skilled credit analysts, and bonds will only be included in the portfolio if they stack up on fundamental grounds as well as from a valuation point of view,” said the analysts at Square Mile.

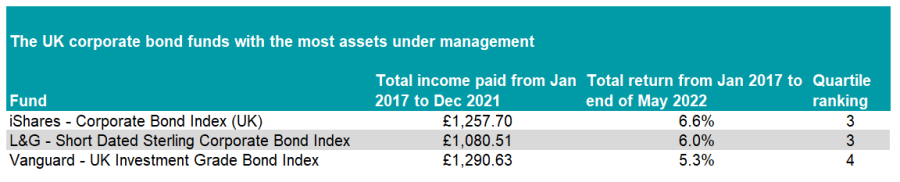

Conspicuous by their absence are the three largest funds in the sector, which are all passives: iShares Corporate Bond Index (£4.7bn), Vanguard UK Investment Grade Bond Index (£3.7bn) and L&G Short Dated Sterling Corporate Bond Index (£2.9bn).

Source: FE Analytics

On average the three have paid out less than the wider sector, while making total returns that placed them in the third or fourth quartile over the period.