Multi-asset funds can be used by investors as a one-stop shop option – putting their cash into one fund designed to give maximum diversification. But within this there are multiple ways that these portfolios can invest.

Even among the most cautious, there are still those that are relatively risky. Similarly, there are more cautious versions of aggressive portfolios.

In this series, Trustnet looks at the funds with the highest upside and downside capture ratios versus a relevant benchmark over 10 years.

Here we looked at the four main mixed-asset groups: IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares, IA Mixed Investment 40-85% Shares and the IA Flexible. With no clear benchmark for each, we chose to use the sector average for comparison.

An upside score of more than 100% shows that a fund made more than the market when it rose, while a downside capture ratio of less than 100% shows they made a smaller loss during tougher times.

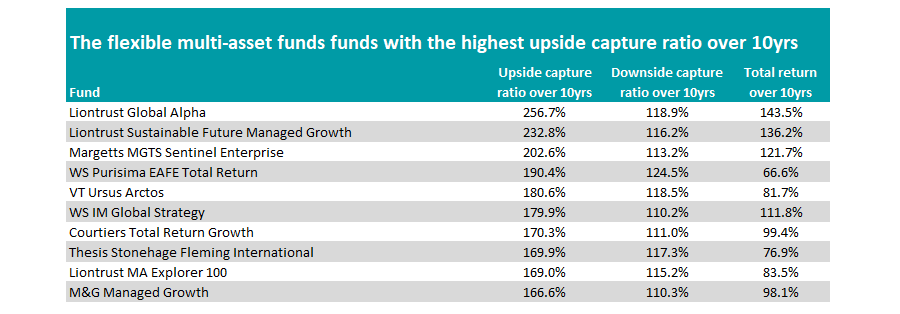

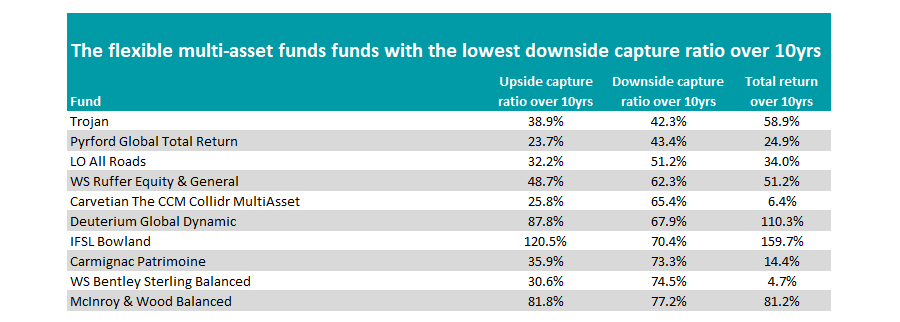

Starting with the widest ranging sector, funds in the IA Flexible have no limit on how much they can hold in equities. However, this means that there is a large disparity between funds that go all-out on stocks and those that own very little.

Indeed, the fund with the highest upside capture ratio relative to its peers was the Liontrust Global Alpha fund, which rose by more than double its peers when the sector rose.

It was the second best performer in the sector over the past decade and has been managed by Tom Record since the departure of veteran stock picker Robin Geffen earlier this year.

Source: FE Analytics

Liontrust Sustainable Future Managed Growth and MGTS Sentinel Enterprise rounded out the top three and also made more than double their peers when the sector rose.

Conversely, those funds that used their flexibility to protect investors’ cash had poor upside scores but shone when their peers fell.

Over 10 years, Trojan and Pyrford Global Total Return both fell by half the amount of their peer group when the sector was down, but struggled during the good times, with upside capture ratios of 38.9% and 23.7% respectively.

Source: FE Analytics

On average, the 10 funds with the highest upside capture ratio vastly outperformed their more conservative rivals with an average return of 115.5%. The top 10 funds with the lowest downside capture ratio made less than half this (54.6%). This trend occurred throughout this study with this pattern repeated across all mixed investment sectors.

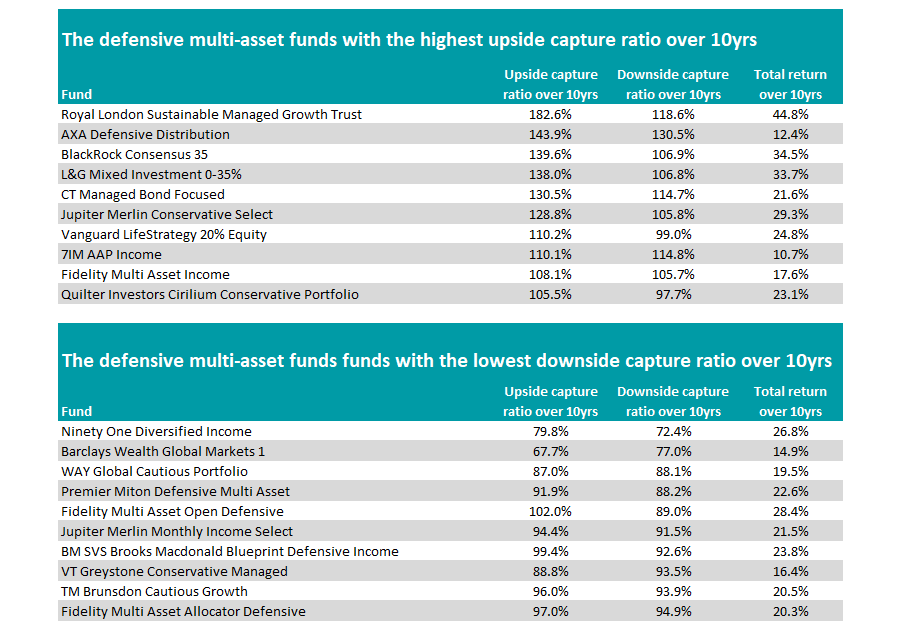

Turning to the three sectors where funds are limited in their band of equities, here the numbers were less stark, although some still stood out.

In the most defensive of the three sectors – IA Mixed Investment 0-35% – Royal London Sustainable Managed Growth Trust had the highest upside capture ratio over the decade (182.6%), which helped it to a 44.8% total return, the highest in the peer group over 10 years.

Source: FE Analytics

BlackRock Consensus 35 and L&G Mixed Investment 0-35% – the second and third best performers of the decade – had upside scores of 139.6% and 138% respectively, third and fourth highest on the list.

On the downside protection front, Ninety One Diversified Income shielded investors when the peer group fell best, with a ratio of 72.4%, although its total return was lower at 26.8%.

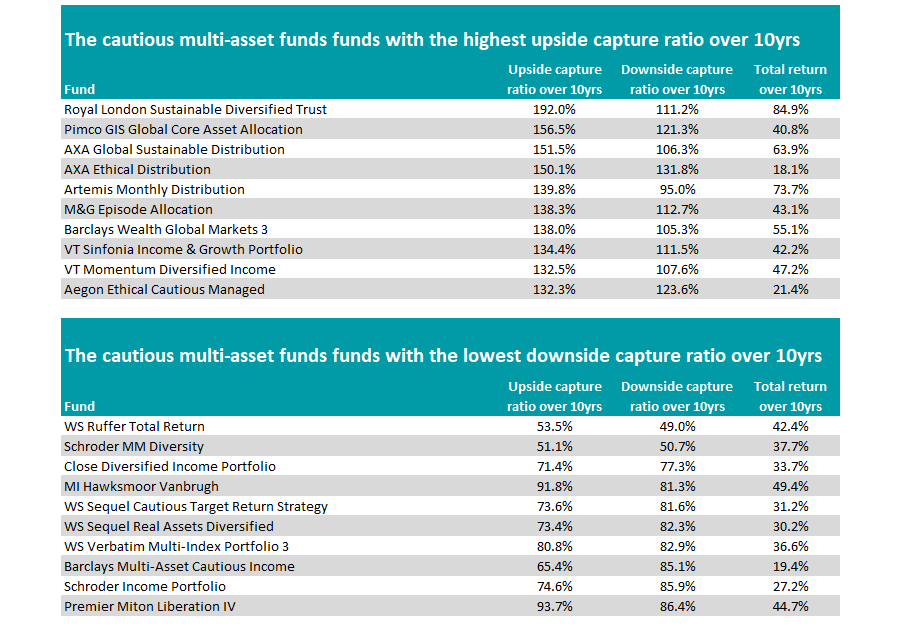

Taking one step up the risk scale, in the IA Mixed Investment 20-60% Shares sector, big names dominated the best defensive funds, with WS Ruffer Total Return and Schroder MM Diversity the two best at protecting on the downside.

Their capture ratios of 49% and 50.7% meant that they fell by roughly half the amount of the peer group in difficult times – although their upside capture ratios also hovered around 50%, as the below table shows.

Source: FE Analytics

Royal London Sustainable Diversified Trust topped the upside list, with a ratio of 192%, which helped it to make the best return of the decade, up 84.9%.

AXA Global Sustainable Distribution (third) and Artemis Monthly Distribution (second) rounded out the top three performers of the decade. The former had the higher upside capture ratio, but the latter was better on the downside.

Lastly, looking at the most aggressive of the equity bands – although funds in this group are referred to as ‘balanced’ – the top performer in the IA Mixed Investment 40-85% Shares again had the highest upside capture ratio.

Royal London Sustainable World Trust was the only fund to make more than double its peer group during strong periods, making a total return of 155.3% over the decade.

However, the next-best performer of the 20 on the below table came from the section for funds with the lowest downside capture ratio. Orbis Global Balanced had a 79.4% downside score, while also beating its peers in rising markets with an upside capture ratio of 114.5%. Overall, it was the third best performer in the sector, up 118.2% over 10 years.

Source: FE Analytics

The second best performer in the IA Mixed Investment 40-85% Shares sector over the decade, Nedgroup Global Flexible, was 11th on both lists, showing consistency in both rising and falling markets.

This is part of a series looking at the best aggressive and cautious funds in different sectors over 10 years. Previously we have looked at emerging markets funds, global, US and European funds, as well as UK all companies, UK income and UK small-cap portfolios.