The Nasdaq was arguably the index to beat this year, as US technology mega-caps dominated the market.

That does not mean the tech-heavy index has been invincible, as some investment trusts have delivered even higher returns year-to-date.

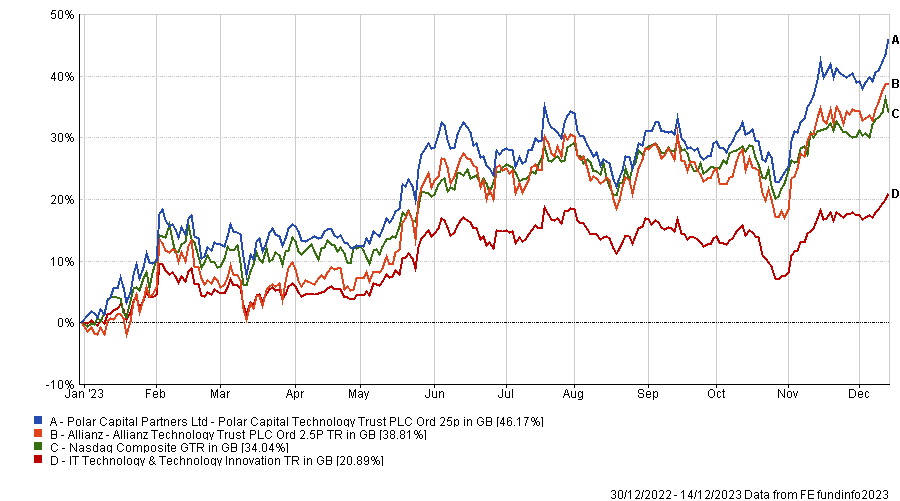

One of the ways to outperform the Nasdaq was to have an even higher technology weighting than the index itself.

As such, tech specialists Polar Capital Technology Trust and Allianz Technology Trust have both beaten the Nasdaq this year, returning 46.2% and 38.8% respectively.

Performance of trusts YTD vs sector and Nasdaq

Source: FE Analytics

Polar Capital Technology Trust is run by Ben Rogoff, Fatima Iu, Nick Evans, Xuesong Zhao and Alastair Unwin, with each of them specialising in different areas of the technology sector and aiming to find the most attractive growth opportunities in the next generation of technology leaders.

Analysts at Square Mile said: “The trust is managed by experienced investors who are skilled in identifying changing industry trends and the companies that are poised to benefit as a result.

“Technology is constantly evolving and continued vigilance is required by the managers to keep informed of developments.

“We believe this is an attractive strategy for long term investors who are looking for exposure to rapidly growing technology companies.”

It has also been a good year for Japanese equities, with the Nikkei hitting a 33-year high in spring. Yet one investment trust stood out in particular, as it outperformed both its Japanese equity peers and the US Nasdaq.

Nippon Active Value Fund has returned 39.8% this year, thanks to its ‘activist’ approach to Japanese small-caps. In other words, the trust invests in smaller companies with strong cash reserves and engages with them to improve capital allocation and to better align shareholders’ and management’s interests.

Due to the underlying approach, the strategy is quite concentrated, with the top 10 holdings accounting for 63.3% of the portfolio.

Nippon Active Value has also absorbed its competitors abrdn Japan Investment Trust and the Atlantis Japan Growth Fund this year, bringing its assets under management to £290.3m.

Performance of trust YTD vs sector and Nasdaq

Source: FE Analytics

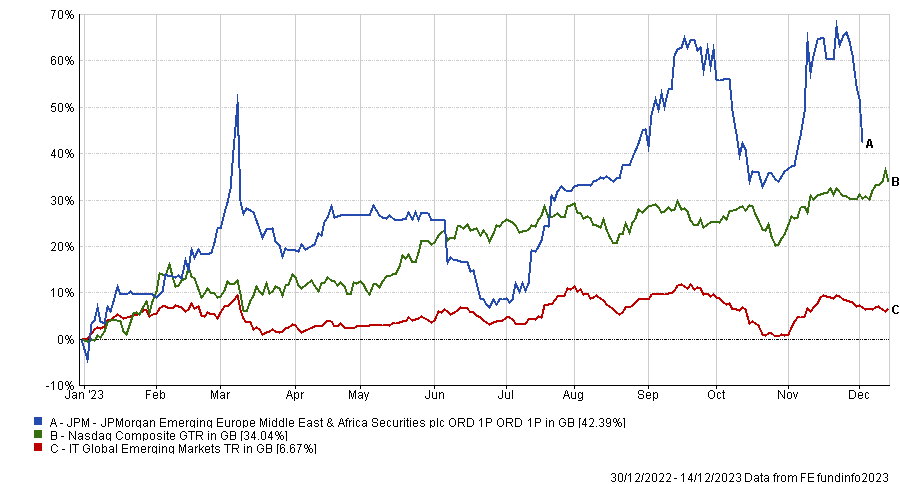

Elsewhere, JPMorgan Emerging Europe Middle East & Africa Securities, formerly JPMorgan Russian, had a better year after a disastrous 2022.

Following Russia’s invasion of Ukraine, Russian securities have been frozen and the trust had to change its mandate to Central, Eastern and Southern Europe, the Middle East and Africa.

According to the Association of Investment Companies, the trust’s largest geographic allocations currently are Saudi Arabia, South Africa and the United Arab Emirates.

Performance of trust YTD vs sector and Nasdaq

Source: FE Analytics

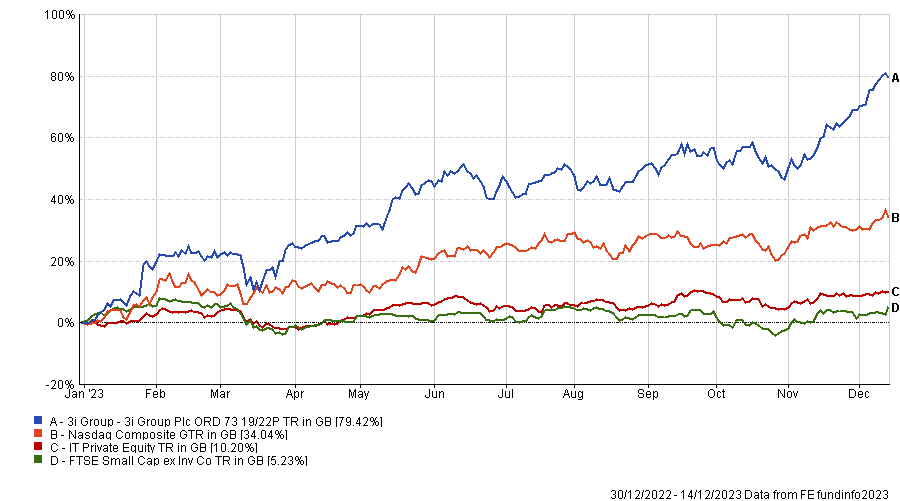

At the top of the list, 3i Group is the investment trust that outperformed the Nasdaq by the widest margin, with a difference of 45.4 percentage points.

Some of this private equity trust’s holdings include Dutch discount retailer Action, Danish retail furniture chain BoConcept and German online retailer of lighting products Luqom Group.

Performance of trust YTD vs sector, benchmark and Nasdaq

Source: FE Analytics

3i Group has also been the best performing trust in the IT Private Equity sector over 10, five and three years.

Global equity trust Manchester & London has also outperformed the Nasdaq this year. This trust aims to deliver capital growth through global equities with a preference for blue chips. Its two largest holdings are Microsoft and NVIDIA, which respectively account for 32.1% and 20.3% of the portfolio, according to the trust’s November 2023 factsheet.

Performance of trust YTD vs sector, benchmark and Nasdaq

Source: FE Analytics

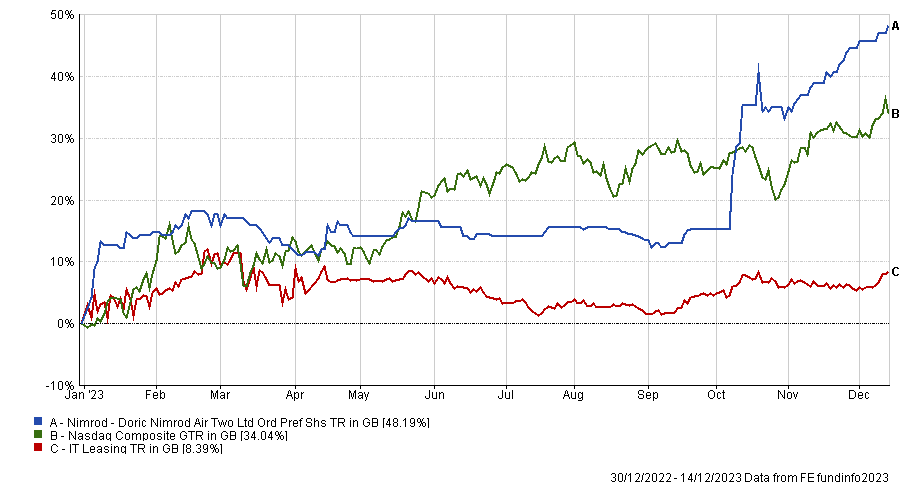

Finally, leasing specialist Doric Nimrod Air Two has also generated higher returns than the Nasdaq.

The trust leases and sells a portfolio of aircrafts to travel companies. Its aircraft fleet includes seven Airbus A380-861, which it is currently leasing to Emirates Airline.

Performance of trust YTD vs sector and Nasdaq

Source: FE Analytics

Due to the nature of its investments, Doric Nimrod Air Two suffered during the Covid-19 pandemic when the world shut down but has rebounded strongly this year.