Investors have turned towards alternative assets in 2022 as a way of protecting against losses, with equity and bond funds going down in unison as inflation has risen and central banks have raised interest rates.

Infrastructure, property and specialist trusts such as debt, leasing and royalties all may appeal to investors who want a steady and secure income, whether it be for retirement or to help supplement earnings during the cost-of-living crisis.

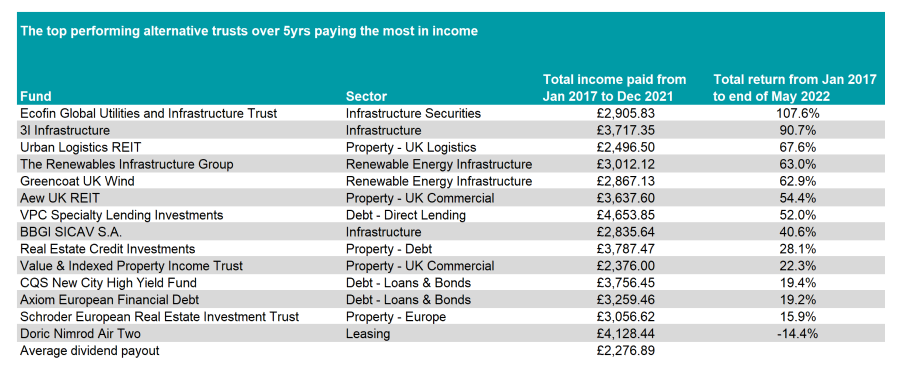

As such, Trustnet decided to look at the funds that have made above-average payouts between 2017 and the end of 2021 across the investment trust sectors that investors may have turned to for income. All data is based on an initial £10,000 investment on 1 January 2017.

We then filtered out any that were unable to make a top quartile return among their sector peers over five years.

Source: FE Analytics

The top performer on the list was the Ecofin Global Utilities and Infrastructure Trust, which has paid out £2,905.83 in dividends over the past five years on an initial £10,000, while making a total return of 107.6% – a top-quartile effort among its infrastructure securities peer group.

The £230m five FE fundinfo Crown-rated trust targets a 4% yield from its underlying holdings, although can use gearing and revenue reserves if required.

It is split between utilities, renewables transportation and integrated infrastructure systems, with its largest allocation to Europe, followed by the US.

Although the Ecofin Global Utilities and Infrastructure Trust is one of two trusts in the IT Infrastructure Securities sector, it has more than doubled the returns of its peer Premier Miton Global Renewables Trust over the period.

Sticking with infrastructure, 3i Infrastructure was the second-best performer, up 90.7% in total return terms while paying out £3,717.35 over the period.

However, investors should note that the trust delivered a bumper payout in 2018 of £2,098.47 as part of a one-off special dividend, which was five times higher than the previous year’s £412.21.

The trust is part of the IT Infrastructure sector and was joined by peer BBGI SICAV SA, which also made the list.

A number of property funds achieved decent returns with high payouts, including the £762m Urban Logistics REIT, which rents out warehouse space to companies that deliver the ‘last mile’ part of the supply chain. It has paid out £2,496.50 over the past five years while making a total return of 67.6%.

AEW UK REIT, Real Estate Credit Investments, Value & Indexed Property Income Trust and Schroder European Real Estate Investment Trust all made the list despite varying performances.

Each one is from a different sector, however, with some performing well against their peers despite lower returns overall.

This is the case with the Doric Nimrod Air Two trust, which makes the table despite making a loss of 14.4% over the five years. Although down, it has significantly outperformed the other two trusts in the IT Leasing sector.

The trust acquires, leases and then sells a portfolio of aircraft to travel companies, but suffered during the pandemic when the world economy shut down. It has remained under pressure despite a global recovery as the backlog of supply has caused chaos at airports.

This article is part of an ongoing series into income portfolios. Previously we have looked at the IA UK Equity Income, IA Global Equity Income, IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors, as well as IA Sterling Strategic Bond and IA Sterling Corporate Bond. We have also looked at the equity income investment trust sectors.