Despite the Covid-19 pandemic that has had devastating consequences worldwide, investors still favour many of the large-cap tech names were already dominating markets before the coronavirus emerged.

Indeed, the Nasdaq has recently reached a new high, driven by a handful of familiar consumer-facing tech names dominating during the pandemic, and is showing no signs of abating.

However, for some there are worrying similarities between the Nasdaq today and the market conditions of the dotcom bubble of 1999-2000.

“It now has a price-to-earnings ratio [P/E] of 37.2, higher than the peak 35.8 P/E ratio in 2001, soon after the internet bubble burst,” said Morgan Stanley’s chief investment officer Lisa Schalett recently, adding that the tech sector’s outperformance relative to the broader market has reached its highest level since July 2000, another echo of that era.

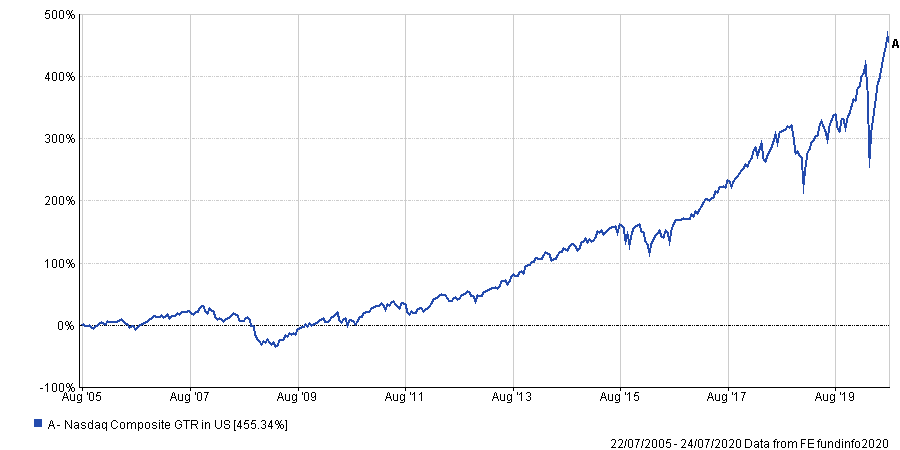

Performance of the Nasdaq over 15 years

Source: FE Analytics

When determining if equity markets look like they are in a bubble, Hugh Grieves, manager of the £756m LF Miton US Opportunities fund, looked to the valuations of some of the popular tech names.

“What does a bubble look like?” he asked. “Are valuations stratospheric? When you look at something like Zoom, Tesla, and Docusign, well, valuations are kind of up there.”

He added that when there is a narrative that gets people excited, it could also be a sign of a bubble.

“In 1999 we had the launch of the internet, consumers realising that technology around them was changing very quickly and you had Y2K which was forcing a lot of companies to spend money to make sure their system still worked in January,” Grieves explained.

“You’ve got a similar thing now, everyone’s working from home and everyone is realising it’s a change. Instead of ‘have you got the latest Nokia phone?’, it’s ‘have you got the latest Tesla EV outside?’

“It fuels the belief that the world is changing more quickly than ever and you’re going to make a lot of money out of it.”

He added that much like the last tech bubble, there are a lot of new investors entering the market, and that it is typically not a good sign.

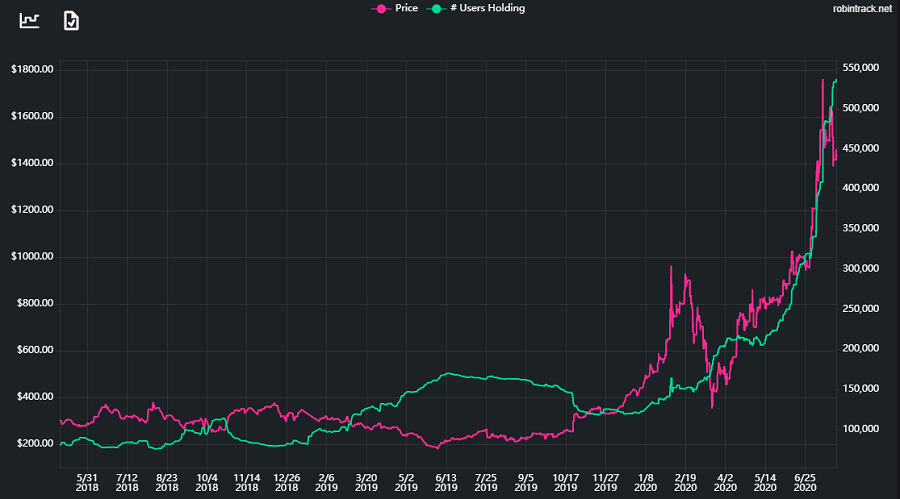

For instance, the number of new Robinhood account openings – the commission-free investing platform – almost perfectly correlates to the stock price of Tesla, noted Grieves.

New Robinhood account openings and stock price of Tesla

Source: Robintrack.net

The Miton manager explained there is a similar correlation among many other stocks “that are basically concentrated on names most consumers would know about, whether it’s Zoom or Docusign or other working-from-home stocks that people know and love”.

Another reason why he is sceptical of the rally is due to the concentration of the five biggest names of the S&P 500 index – Microsoft, Apple, Amazon, Facebook and Alphabet – which make up almost 24 per cent of the index.

“It creates pressure for fund managers to hold these mega-cap stocks which are doing so well and that’s created the virtuous circle for these stocks,” said the LF Miton US Opportunities manager.

“The more they go up, the bigger part of the index they become, the more people buy them,” he explained. “There has certainly been a tendency for them to crowd into these names, and hence their performance all look alike.

“Performance has looked very similar on the way up, and it will likely be similar on the way down.”

If the top-five stocks of the index were removed, the returns for the rest of the market returns have been broadly flat for the past several years, and that Grieves reckons that this is unsustainable and “usually doesn’t end well”.

“If they start underperforming the rest of the market, it’s going to pull the whole market down,” he said. “It’s been great holding a passive tracker for the last couple of years because these stocks have done really well, but holding a tracker is not going to look so clever if the average stock in the index which had been underperforming suddenly starts outperforming significantly.”

Indeed, Morgan Stanley’s Schalett has also observed a lot of crowding, noting: “A close look at market indices shows that investors have crowded into a handful of tech leaders.

“Another example of how narrow the market has become: When the S&P 500 pulled back 5 per cent in June, an equal-weighted version of that index declined more than 11 per cent, suggesting that the big tech names were supporting the broader index.

Crowding is a risk because it may mean that even a relatively minor negative news event for a tech leader could trigger a sell-off and a sharper-than-expected downdraft for the broader market,” she explained.

Amanda Lyons – manager of the $303.2m GAM Star Disruptive Growth fund – said it was important to focus on the fundamentals when assessing valuations.

She said: “Some of these work-from-home names are very difficult to justify at these levels. They’re priced more than for perfection.”

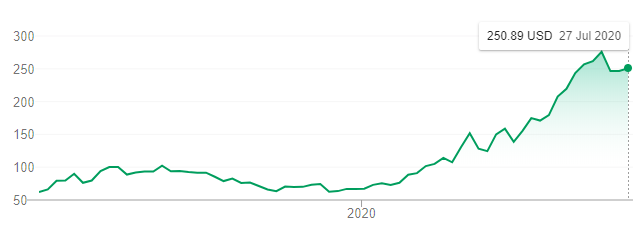

“Zoom is an example of that. It’s great technology and at one point I was subscribing, but that need has now gone away. Zoom does not operate in a world without competition, but that is what the price is suggesting.”

She believes that Zoom still has a great long-term story and a great product, however the price is hard to justify.

“It’s almost pricing itself if everyone in the world is going to be a Zoom user forever. I’m not convinced that’s necessarily going to be the case,” she added.

Performance of Zoom since IPO

Source: Google Finance

Pieter Fourie, head of global equities at Sanlam Investments, said the fundamentals for many of the tech stocks today are different to that of the tech bubble.

“I don’t believe names like Facebook and Alphabet are as bad as a name like Cisco was back in 1999,” he said. “The world has changed a lot fundamentally for Cisco since 1999 which has meant their core business of routers has over time struggled to perform.

“Whereas if I look at digital media or digital advertising and the long term growth opportunity in that market is still very much a double digit growth opportunity and we don’t believe that Google and Facebook two or three years forward looking is as overvalued as Cisco was at the time.”

He continued: “It’s fair to say to some in cases that valuation support has been stretched quite a bit.

“Whether you look at names like Amazon or Paypal, those companies do have significantly advantaged fundamentals versus the rest of the market, but you’re paying 90x or 50x earnings, and that’s adjusted for all kinds of exceptionals that are excluded.”

He has observed that the market has pushed up valuations of high-quality companies and high-growth companies in particular, because investors are not worried about valuations in the short term but more about the story around if it is affected by Covid-19.

When comparing the valuations to 1999, he said that unlike today, the US market in 1999 had a lot of industries that were defined as growth companies.

“Even your pharmaceutical businesses, industries like GE, a lot of those businesses were also on 40 or 50x earnings,” said Fourie. “The overall valuation of a name like Microsoft was a lot more expensive back then, and a large part of the US market was overvalued at that stage to a larger extent than what I can see today.

Richard Marwood, manager of the £812m Royal London UK Dividend Growth fund, also noted the bifurcation of valuation between the perceived Covid-19 winners and losers.

“In the UK equity market, there’s definitely a huge valuation difference between two types of stocks where people are willing to pay very high multiples for anything that’s got a decent story and a degree of certainty behind it,” he said.

“When you look at the P/E ratios and compare them historically you could potentially say ‘yes’ you are paying too much. But actually, if you compare it to cash, given where interest rates are at the moment, the P/E on cash is absolutely enormous.

“So, if you’ve got something that genuinely is going to maintain its earning power or show any kind of growth at all, maybe it’s not that expensive relative to cash.”

He concluded: “If these businesses are genuinely immune from economic conditions as people think them to be, then maybe it is warranted to pay that much.”