Investors that rely on income have had a tumultuous few years, firstly with the pandemic and then latterly with the threat of rising inflation and interest rates.

One area that many have highlighted is investment trusts, which were able to retain excess income in the past but as things have improved for dividend payers can now start to increase payouts while replenishing their reserves.

However, there are only three trust sectors dedicated to equity income: IT UK Equity Income, IT Global Equity Income and IT Asia Pacific Equity Income.

Rather than dividing these into their own sections (there are only 34 trusts in total across the three peer groups) Trustnet looked at the three sectors together.

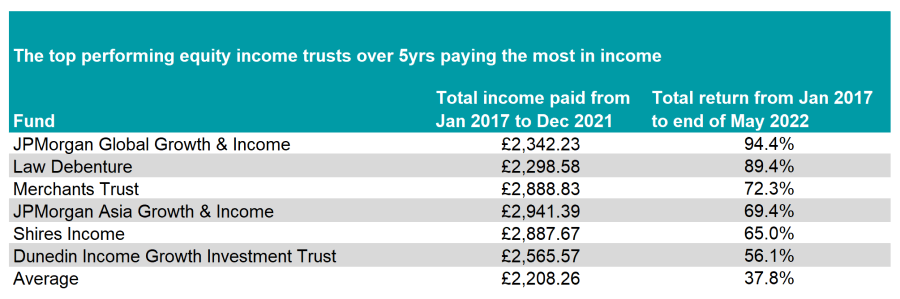

To do this, we calculated the income paid on an initial £10,000 investment made at the start of 2017 to the end of 2021 and excluded those that had paid less than average.

We also looked at the portfolio’s total return over that time, putting all trusts from the three sectors into one list and filtering this down to those in the top 25%.

Source: FE Analytics

The top performing portfolio on the list has been the JPMorgan Global Growth & Income trust, which has made 94.4% over five years while paying out £2,342.23 in income.

It has been the top trust in the IT Global Equity Income sector over that time and is the only entrant from the sector to make the cut in this research.

Managed by Timothy Woodhouse, Helge Skibeli and Rajesh Tanna, the £681m fund has a yield of 4.1% and pays out a quarterly dividend, with total payouts for the year equal to at least 4% of the trust’s net asset value at the beginning of the financial year.

However, it is not an income-only strategy. Indeed, the trust is 66.5% weighted to the US, while it has nothing in the UK – a high-yielding market.

The total return strategy (combining an income stance with the requirement of capital growth) means that the portfolio is style agnostic, with its largest three sector weightings to financials, technology and healthcare.

The rest of the list is dominated by UK trusts, with four of the remaining five investing in the domestic market. Law Debenture was the pick of the trusts, returning 89.4% while paying out £2,298.58 on an initial £10,000 investment.

It has been the best portfolio in the IT UK Equity Income sector over the past five years but is a unique proposition. Indeed, it is split between an equity portfolio and an independent professional services business.

Managers James Henderson and Laura Foll look after the traditional equity section, which invests across the UK market and is predominantly allocated to ‘value’ areas such as financials, industrials and oil.

Merchants Trust, Shires Income and Dunedin Income Growth round out the UK entrants. They have been the second, third and fourth-best performers in the IT UK Equity Income sector from January 2017 to May 2022.

The trust paying the most in dividends over the five years, however, was the JPMorgan Asia Growth & Income, the only entrant from the IT Asia Pacific Equity Income sector.

It has paid out £2,941.39 over five years while returning 69.4% in total returns. This places it second among its peer group of five, 2 percentage points behind the top trust (Invesco Asia), which did not pay enough in income to qualify.

Although Asia is not considered a particularly high-yielding market, the emphasis on dividends is growing and payouts are increasing rapidly year-on-year.

The trust already has a high yield of 5% and like its global stablemate above invests in both fast-growing and high-yielding stocks to deliver rising payouts and capital growth.

It is predominantly invested in China, Korea, Taiwan and Hong Kong, with sector bias split between financials, technology and consumer stocks, which make up around two-thirds of the portfolio.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Gearing | Premium/discount |

| Dunedin Income Growth Investment Trust | IT UK Equity Income | £418m | Ben Ritchie, Georgina Cooper | 4.6% | 0.59% | 8.2% | 1.4% |

| Shires Income | IT UK Equity Income | £81m | UK Equity | 5.2% | 1.21% | 19.4% | 3.4% |

| Merchants Trust | IT UK Equity Income | £730m | Simon Gergel | 5.1% | 0.59% | 10.3% | 1.5% |

| JPMorgan Asia Growth & Income | IT Asia Pacific Equity Income | £357m | Ayaz Ebrahim, Robert Lloyd | 5.0% | 0.77% | 0.0% | -8.7% |

| JPMorgan Global Growth & Income | IT Global Equity Income | £681m | Timothy Woodhouse, Helge Skibeli, Rajesh Tanna | 4.1% | 0.53% | 0.0% | 3.3% |

| Law Debenture Corporation | IT UK Equity Income | £987m | James Henderson, Laura Foll | 3.8% | 0.50% | 17.9% | 4.6% |

This article is part of an ongoing series into income portfolios. Previously we have looked at the IA UK Equity Income, IA Global Equity Income, IA Mixed Investment 0-35% Shares, IA Mixed Investment 20-60% Shares and IA Mixed Investment 40-85% Shares sectors, as well as IA Sterling Strategic Bond and IA Sterling Corporate Bond.